Lockstake

Terms

nDAI— normalized DAI ==art<- X— called by a user/external entity

What is Lockstake?

— Lock MKR to farm, vote, and use as collateral. 15% fee on withdrawal - https://endgame.makerdao.com/tokenomics/sagittarius-engine

LockstakeClipper

- Qs

- What is LockstakeClipper? — Modified clipper, called by Dog (.bark)

- README for contest

- Is it in scope or only diff? — Most of the issues OOS, only diff:

- https://security.makerdao.com/liquidations-2.0

- Everything from the original clipper

- Readme inside repo (lockstake/README.md)

- proxy-manager-clipper — auctions for situations when collateral is deposited somewhere (e.g., compound)

- (used for dss-crop-join). — allows depositing collateral somewhere to get profit

- DSS-Crop-join introduces support for new ilks with a join adapter facilitating the staking of the collateral tokens in a third-party system to generate rewards instead of simply holding the tokens at the join adapter. The generated reward is distributed amongst the users the collateral belongs to.

- https://www.chainsecurity.com/security-audit/makerdao-dss-crop-join

- https://forum.makerdao.com/t/mip30-farmable-cusdc-adapter-cropjoin/5163

- What did they even change? — flux ⇒ slip, engine callbacks. Probably LSE will handle collateral after it is slipped (just change the gem amount)

- Check diff

- flux vs slip — move vs just update

- vat.flux — move gem (internal collateral balance) to another account. Checks for msg.sender or approved ^vat-flux

- vat.slip — just change gem (free collateral, not yet in any urn) balance, nothing else, authed ^vat-slip

- engine callbacks

- flux vs slip — move vs just update

- Check diff

- Readme inside repo further

- “sends the taker callee the collateral (MKR) in the form of ERC20 tokens and not

vat.gem” What does it mean? — Sends collateral to liquidator- taker callee — liquidator selects where to send collateral, taker=liquidator, callee=where(address)

- ERC20 vs vat.gem implications — Probably just for convenience, no need to exit .gem to ERC20

- exit fee — 15% paid when withdrawing MKR (collateral)

- “MKR (collateral) leftovers upon completion of the auction” — dent phase can leave more collateral in an urn

- why and when is it left? — Because of the

dentphase- does it use the same auction as original DSS? — Mostly yes, so first increase the DAI paid, then decrease collateral

- do they sell 100% of collateral or what — Same

- Is auction not for 100% of collateral — According to docs 100%, dog.bark

- why and when is it left? — Because of the

- “incentives for self-liquidation” which ones? — Probably exit fee avoidance (but not sure if it’s kept or not, see 1-fee), but maybe also to socialize bad debt, get rewards from protocol

- ilk’s liquidation ratio (

mat) — lower ⇒ can liquidate ^spot-ilk-mat- how is it stored? — 1.45e27

- get mkr contract, spot?

- https://chainlog.makerdao.com/

- spot https://etherscan.io/address/0x65c79fcb50ca1594b025960e539ed7a9a6d434a3#readContract#F1

- ETH 0x4554482d41000000000000000000000000000000000000000000000000000000 ⇒ 1.45 e27

- ilk registry .list https://etherscan.io/address/0x5a464c28d19848f44199d003bef5ecc87d090f87#readContract#F11

- spot https://etherscan.io/address/0x65c79fcb50ca1594b025960e539ed7a9a6d434a3#readContract#F1

- https://chainlog.makerdao.com/

- get mkr contract, spot?

- how is it stored? — 1.45e27

ink * price / mat = debt— ‘collateral in ~USD scaled down by liquidation ratio = debt’ is the limit, or debt scaled up bymatshould be ⇐ collateral- chop — penalty in %, like 1.13

- amt of collateral sold

debt * chop / price— debt in USD + fee in collateral tokens- In which tokens is debt — ~USD

- then why do we divide on price — to get collateral amt

- “Since we need to make sure that only up to

(1-fee)of the total collateral is sold (wherefeewill typically be 15%), we require:② debt * chop / price < (1-fee) * ink” ^LSC—1-fee- Why (1-fee)? — We need to keep the fee for the protocol, can’t sell all the collateral? hmm

- Where does the fee go? We just keep it on the protocol or can give to a liquidator too? — ^LSC-take calls ^LSE-onRemove, which seem to burn MKR

fee - Why don’t we send the fee somewhere on deposit if it’s not a reward for liquidation? — It’s for an auction, but because of overcollateralization it will be probably left

- Oh,

feeis the Maker term here? — Kind of, it’s just exit fee, but also afeevariable

- Where does the fee go? We just keep it on the protocol or can give to a liquidator too? — ^LSC-take calls ^LSE-onRemove, which seem to burn MKR

debt * chop / price < (1-fee) * ink— debt + liquidator premium < collateral available- Explanation: debt + liquidator premium < collateral available (without exit fee) (all in ~MKR)

- debt — debt in ~USD

- chop — liquidator premium

debt * chop / price— debt + premium in collateral (~MKR)(1-fee) * ink— collateral left after 15% fee

- Explanation: debt + liquidator premium < collateral available (without exit fee) (all in ~MKR)

- Why (1-fee)? — We need to keep the fee for the protocol, can’t sell all the collateral? hmm

mat > chop / (1 - fee)— mat covers both (liquidator bonus) * (exit fee)- ⇒ > 1.18 * 1.13 (1/0.85 ~ 1.18)

- ⇒ > debt + (exit fee) + (liquidator bonus)

-

- Because debt limit is collateral scaled down by LTV

-

- And debt + liquidator fee must be < collateral available

- chop — liquidator bonus

chop / (1 - fee)— liquidator bonus * 1.18

chip- Percentage of tab to suck from vow to incentivize keepers. — how much DAI to mint to keeper at the expense of vow (the system)- tab — DAI wanted from auction, DAI debt

- suck — vat.suck: add the bad debt (in DAI) on u, give the same DAI to v ^vat-suck

- Define — add bad debt to u, mint

daito v, increase total bad debt and totaldai- sin —

[address => bad debt DAI] - dai —

[address => balanceOf DAI] - vice — total sin, total bad debt DAI

- sin vs vice — [] vs [].sum()

- debt — dai.sum()

- sin —

- Define — add bad debt to u, mint

- vow — debt and surplus counter

- “sends the taker callee the collateral (MKR) in the form of ERC20 tokens and not

- How does lsmkr move? ^Q—lsmkr-move

- Where is it minted, and to whom:

LSE._lock; — tourn, user provided LSUrn, created by LSE-

urnmust haveurnOwners[urn]that is set only on LSE.open ⇒urnis LockstakeUrn - LSE.lock ←X

- LSE.lockNgt ←X

-

- LSE.onRemove; — to liquidated

urn- LSC.take ← X; to: liquidated

urn- to:

sales[id].usr, id istaker provided ^Q—lsmkr-move—to-usrsales[id].usrset on LSC.kick- called by dog.bark

urn, provided by caller/liquidator, liquidatedurn

- called by dog.bark

- Can we change .usr? — no

- Can we call .bark for the same urn? — nope, id is ++ on each kick

- If price goes down again? — nope, id = kick++

- others — no other changes

- Can we call .bark for the same urn? — nope, id is ++ on each kick

- to:

- LSC.yank ← END.sol; to: same as in

take, liquidatedurn

- LSC.take ← X; to: liquidated

- Where is it burned and to whom:

LSE._free; — to: urn, user provided, but uses ^LSE-urnAuth- free

- freeNgt

- freeNoFee

- LSE.onKick: — to: liquidated

urn- LSC.kick

- to: same as ^Q—lsmkr-move—to-usr

- LSC.kick

- Where is it approved and to whom

- LSUrn.init; — to: LSE; amt: max

- lsmkr.approve(msg.sender, type(uint256).max);

- who is msg.sender? — LSE on LSE.open

- lsmkr.approve(msg.sender, type(uint256).max);

- LSUrn.stake; — to: user-selected

farm, but gov approved; amt: all ink(MKR, collateral) onurn; or newly transferred MKRLSE._selectFarm- user provided, but from gov approved

LSE._lock- to the same selected farm, additional funds

- Approves using lsmkr.approve(farm, wad);

- LSUrn.init; — to: LSE; amt: max

- Where is it moved/transferred? — only on farm, but it can only be called by LSUrn ⇒ LSE

- from LSUrn — no lsMkr transfers

- by LSE — no lsMkr transfers

- by farm — safeTransfer from/to msg.sender

- possible to farm on some other address, then can withdraw some lsMKR?— no, only on msg.sender

- Can the user transfer/burn it or is it stored somewhere? — it is stored on LSUrn or SR, that does not allow transfers or approvals (unless …)

- If we can move or burn lsMkr — does not seem that we can

- something will revert because it expects urn to have it?

- probably

take - other functions that burn/transfer

- probably

- something will revert because it expects urn to have it?

- ^LSE—lsMkr-flow

- Where is it minted, and to whom:

- What is LockstakeClipper? — Modified clipper, called by Dog (.bark)

- kick — start an auction, withdraw MKR to LSE ^LSC-kick

- Qs

- “trusts the caller to transfer collateral to the contract”, where does it happen? — in dog.bark using vat.grab ^LSC-kick-Q-transfer

- caller — dog.bark

- does dog.bark do it? — yep

- vat.grab? — urn.ink(collateral) ⇒

vat.gem[clip]; urn.debtDai ⇒ vow; ^dog-bark—vat-grab- move user’s (urn) collateral(gem) to clip(LSClipper) and DAI debt to system (vow);

- reduce urn’s collateral and DAI debt, increase vow’s surplus and bad debt in DAI

- dog.bark pass args:

- milk.clip — auction address for this collateral

- milk — memory collateral struct

- clip — clipper(auction) address

- vow — debt/surplus ledger

- dink — diff collateral balance

- dart — diff normalized DAI balance (no rate applied yet, so not a real balance)

- milk.clip — auction address for this collateral

- ink — collateral balance of an urn

- dtab — DAI wanted from auction

- gem — free collateral tokens

- vat.gem vs urn.ink — free collateral with locked in urn

- sin —

[address => bad debt DAI] - vice — total sin, total bad debt DAI

- vat.grab? — urn.ink(collateral) ⇒

- “trusts the caller to transfer collateral to the contract”, where does it happen? — in dog.bark using vat.grab ^LSC-kick-Q-transfer

- args

- tab — auction wanted total in DAI (usually the whole urn’s debt) + penalty ^kick-tab

- what? — auction total in DAI (1e45) + penalty

- Qs

- “total dai wanted from the auction / total dai to be raised (in flip auction)“? — so we replaced flip auctions with clip auctions and it looks like a clip auction

- why “Debt” in comments?

- so we sell collateral (ETH) to cover debt (DAI). Probably how much debt we are ready to cover

- how is it set in dog.bark — DAI to liquidate + penalty ^dog—tab

mul(due, milk.chop) / WAD;— DAI to liquidate + penalty- due =

mul(dart, rate);— DAI to liquidate- dart — nDAI to liquidate (whole urn or system max) ^dog-bark—dart

dart1 = min(art, mul(room, WAD) / rate / milk.chop)— min(nDAI in urn, max nDAI allowed)- art — nDAI of an urn being liquidated

- vat.urns(ilk, urn);

- room/rate/chop — max system limit of nDAI - liquidation penalty

- room — how much DAI is allowed to be auctioned (hole-dirt)

min(Hole - Dirt, milk.hole - milk.dirt)^dog-hole-and-dirt- milk.hole — max DAI in auctions per collateral

- milk.dirt — current DAI in auctions per collateral

- Hole — max DAI in auctions total

- Dirt — current DAI in auctions total

- ChatGPT — all bad debt

- https://docs.makerdao.com/smart-contract-modules/dog-and-clipper-detailed-documentation#limits-on-dai-needed-to-cover-debt-and-fees-of-active-auctions

box— gpt: max Dai debt in the system

- https://docs.makerdao.com/smart-contract-modules/dog-and-clipper-detailed-documentation#partial-vs.-total-liquidations

dunk— set by governance, min amount of debt DAI to liquidate (either it or all vault’s debt)- minimum DAI liquidity requirement

- art — normalized DAI debt

- (normalized outstanding stablecoin debt.)

dunknot used in Dog, can partially liquidate

- rate — multiplier to get DAI from art (nDAI)

(,rate, spot,, dust) = vat.ilks(ilk);

- milk.chop — liquidation penalty, e.g. 1.13

- room — how much DAI is allowed to be auctioned (hole-dirt)

- art — nDAI of an urn being liquidated

- if (art > dart) — not a full liquidation

if (mul(art - dart, rate) < dust)— if DAI left < dust- art - dart1 — nDAI that can’t be liquidated because of system limits

- rate — nDAI to DAI conversion rate

dart = art— if dust left add the dust. So Hole, .hole are not strict limits

- dart — nDAI to liquidate (whole urn or system max) ^dog-bark—dart

- rate — nDAI to DAI converter

- due =

- milk.chop — liquidation penalty, e.g. 1.13. Profit for keeper and Vow

- Goes to maker? Check code — probably goes to vow, see ^milk-chop—does-go-to-maker

- gpt: goes to keeper incentives, surplus goes to vow

- it goes to

kickintab, so not sure

- Goes to maker? Check code — probably goes to vow, see ^milk-chop—does-go-to-maker

- Qs

- what? — auction total in DAI (1e45) + penalty

- lot — collateral amount proportional to tab, usually both 100% ^kick-lot

- How is it set in dog.bark? — usually 100%. proportional to nDAI debt amt liquidatable (hole - dirt) ^dog-bark—dink

dink = mul(ink, dart) / art= ink * dart / art = collateral proportional to liquidated nDAI amount. Usually all- ink — collateral balance of an urn

- dart — DAI to liquidate (whole urn or system max) ^dog-bark—dart

- art — nDAI debt in the urn

- How do we synchronize it with tab amount? Do we need to do it? Or is it a first bid — in dog.bark

- How is it set in dog.bark? — usually 100%. proportional to nDAI debt amt liquidatable (hole - dirt) ^dog-bark—dink

- usr — liquidated urn

- kpr — keeper address, where liquidation reward (coin) will be sent

-

^vat-suck — mint DAI to kpr from vow (create vow debt) ^LSC-kick—vat-suck

-

coin = _tip + wmul(tab, _chip)— liquidator reward: flat fee + % ^LSC-kick—coin

-

- tab — auction wanted total in DAI (usually the whole urn’s debt) + penalty ^kick-tab

- body

- active.push(id); — stores active auction ids ^LSC-kick—active-push

- sales — active auction {id ⇒ struct} ^LSC—sales

- pos; — Index in

activearray - tab; — auction total ^kick-tab

- Dai to raise from the auction

[rad],

- Dai to raise from the auction

- lot; — ^kick-lot

- // collateral to sell

[wad]

- // collateral to sell

- tot; — ~immutable lot at the auction start, to calculate how much was sold for

onRemove- // static registry of total collateral to sell

[wad] - where is it used? — only onRemove to get how much was sold

- // static registry of total collateral to sell

- usr; — Liquidated CDP (urn)

- tic; — Auction start time

- top; — starting auction price in DAI, above market by

*buf^LSC—sales—top- Comment on top of kick

- val — collateral value in UoV (~USD) ^LSC-getFeedPrice

- getFeedPrice — DAI per asset ^spotter

- spotter — ~oracle registry, with a delay. Return pip (oracle) by ilk (collateral type)

- pip — oracle

- pip.peek — get price ^pip-peek

rdiv(uint256(val) * BLN, spotter.par())— val/par; convert UoV from oracle to DAI, e.g. 20EUR/asset ⇒ 25DAI/asset.- val / par

- BLN — 1e9, billion

- spotter.par — UoV/DAI, e.g. 0.8EUR/ DAI.

- val (in EUR) / 0.8 = 1.25 ⇒ 1 EUR = 1.25 DAI

- getFeedPrice — DAI per asset ^spotter

- buf — multiplier to increase the starting price above market

- because it’s auction that goes down we want to start higher than market, so we multiply

- how is it set — gov or trusted

- par — only in ^LSC-getFeedPrice, Unit of Value / DAI, e.g. 0.8EUR/ DAI ^LSC—sales—top—par

- val — collateral value in UoV (~USD) ^LSC-getFeedPrice

rmul(getFeedPrice(), buf)— collateral price in DAI * buffer above market, e.g. 1.2- Where is it used?

- redo

- take

- getStatus

- status

- Comment on top of kick

- pos; — Index in

- if has reward ^LSC-kick—hasReward

- tip — flat reward for keeper ^LSC-kick—tip

- chip — % reward for keeper ^LSC-kick—chip

coin = _tip + wmul(tab, _chip)— liquidator reward ^LSC-kick—coin- vat.suck(vow, kpr, coin); — mint DAI to kpr from vow (create vow debt) ^LSC-kick—vat-suck

- engine.onKick(usr=urn, lot) — withdraw MKR to LSE, lsMKR to LSUrn ⇒ burn this lsMKR ^LSE-onKick

-

Undelegate and unstake the entire

urn’s MKR amount. Users need to manually delegate and stake again if there are leftovers after liquidation finishes. (Readme) inkBeforeKick = ink + wad— collateral of urn before liquidation (dog.bark)- ink — collateral balance of an urn

- wad = lot — collateral amount on the auction ^kick-lot

- Qs

- Why do we add? Do we subtract from the urn on kick or dog.bark? — yes, dog.bark using vat.grab transfer urn debt and collateral to vow ^LSC-kick-Q-transfer

_selectVoteDelegate(urn, inkBeforeKick, urnVoteDelegates[urn], address(0));— here: withdraw urn’s pre-liquidation collateral balance(MKR) from delegate, remove delegate ^LSE-onKick—i-selectVoteDelegate_selectVoteDelegate— here: withdraw wad MKR from the VoteDelegate to LockstakeEngine, remove urn’s VoteDelegateVoteDelegateLike(prevVoteDelegate).free(wad);— return wad MKR to LockstakeEngine ^VD-free

urnVoteDelegates[urn]— urn ⇒ delegatedVotesTo mapping- why address(0) — we don’t want to redelegate, new delegate is address(0)

_selectFarm(urn, inkBeforeKick, urnFarms[urn], address(0), 0)— here: withdraw urn’s pre-liquidation collateral balance(MKR) from farm, remove farm ^LSE-onKick—i-selectFarm_selectFarm(address urn, uint256 wad, address prevFarm, address farm, uint16 ref)^LSE-i-selectFarm

- Can MKR be both delegated and staked? But how? — minting lsMKR 1:1, stake it ^LSE-lockMkrTwice

- lock — deposit MKR to LSE; mint lsMKR to LSUrn; optionally delegate(move) MKR, stake lsMKR ^LSE-lock

- lsmkr.burn — just burn lsMKR

urnAuctions[urn]++— used to disallowselectVoteDelegateandselectFarmwhen auctions are active ^LSE—urnAuctions- onKick ++

- onRemove —

-

- Qs

- take ^LSC-take

- Comment

- Buy using what — DAI, we buy collateral, paying DAI debt

- Who supplies amt — taker (user)

- “if

amtwould cost more DAI thantabat the current price, the amount of collateral purchased will instead be just enough to collecttabDAI”. ^LSC—C-owe-down- ⇒ if request too much

amtwill be limited totabconverted to collateral amount- if

amt(requested collateral amount) would cost more DAI thantab(all debt + penalty), the amount of collateral purchased will instead be just enough to collecttab(debt + penalty all) DAI

- if

- why “

tabat the current price”, isn’t tab already set on kick — tab can decrease when some collateral is bought + decrease with time - amt in MKR, taker(user) provided;

- tab in DAI - auction total, usually the whole urn, if not too many auctions;

- chost = (Vat.dust * Dog.chop(ilk) / WAD) — min value left = dust + penalty ^LSC—chost

- ⇒ if request too much

- “Purchase amounts will be minimally decreased when necessary to respect this limit; i.e., if the specified

amtwould leavetab < chostbuttab > 0, the amount actually purchased will be such thattab == chost.” — iftakewill leave less than allowed dust, then we decrease takeamt^LSC—C-owe-up - “If

tab <= chost, partial purchases are no longer possible; that is, the remaining collateral can only be purchased entirely, or not at all.” — if dust left can onlytakeall ^LSC-take—tab-le-chost

- args

- id — auctionId, set in kick

- amt — user provided limit in MKR (collateral) to buy

- Why do we need it, isn’t all the collateral for sale? — Can buy a part of collateral using the price, the rest will continue to be sold with decreasing price docs clipper

- max — DAI/collateral

- who — where to send bought MKR

- data — passed to who

- body

- ^LSC—sales

- in which case usr(urn) == address(0)? — isAuctionExist: set to 0 by

_remove(After auction finished); And 0 by default, before kick is called. ^LSC-take—usr-addr0 (done, price) = status(tic, sales[id].top)— return: shouldredothe auction?; New price (depends on time) ^LSC-status- args: starting time and price

- calc.price(top, block.timestamp - tic) — return new price, provided start price and time since start

- initial price, seconds since start ⇒ current auction price

- calc — basically just return price on time, using e.g., LinearDecrease, see abaci.sol

done = (block.timestamp - tic > tail || rdiv(price, top) < cusp)— auction time and collateral market price drop are not too high

- owe — DAI to pay;

- TLDR: scaled down to tab (all debt in DAI); or add

chost; see ^LSC—C-owe-down ^LSC—C-owe-up - // DAI needed to buy a slice of this sale

- slice — collateral amount to buy; either all collateral or taker provided value

- owe1 — collateral amount that will be bought in this take, in DAI

- price in which currency? — DAI

- if (owe1 > tab) { — collateral price proposed by the auction increased for some reason (unusual, because it always decreases in Dutch auction)

- How is it possible — ok, maybe if a calc is complicated and cannot only decrease, but also increase price, idk. Don’t see in usual case

- tab — set on auction

kick, can only decrease on eachtake - owe — depends on

price, which only decrease with time - docs

- tab — set on auction

- How is it possible — ok, maybe if a calc is complicated and cannot only decrease, but also increase price, idk. Don’t see in usual case

- owe1 < tab && slice < lot — price decreased and not buying all collateral

- normal case, price decreased. But also don’t buy all collateral

if (tab - owe < _chost)— DAI to raise after thistakeless thandust

owe == tabwhy nothing? — if raise exactly as we want, then all good

- TLDR: scaled down to tab (all debt in DAI); or add

- slice — collateral amount to receive;

vat.slip(ilk, address(this), -int256(slice))— reduce gem (free collateral) by amounttaken- why address(this)? Did we get

geminkick? — almost, in dog.bark- we had MKR on engine after

kick, soonTakeis understandable - dog.bark? — yep, ^LSC-kick-Q-transfer

- we had MKR on engine after

Transclude of #vat-slip

- why address(this)? Did we get

engine.onTake(usr, who, slice)— just move MKR from LSE to who ^LSE-onTake- How did we get MKR to LSE — part from LSE.onKick from voteDelegate, all of it on LSE.lock

- Part from `LSE.onKick`, but only delegated

- Where did we get the rest? — on LSE.lock

- gem added to LSClip on dog.bark always

- how do we put MKR in urn?

- LSE.open + LSE.lock

- Part from `LSE.onKick`, but only delegated

- How did we get MKR to LSE — part from LSE.onKick from voteDelegate, all of it on LSE.lock

- vat.move — transfer DAI from, to, amt ^vat-move

- dog_.digs(ilk, lot == 0 ? tab + owe : owe) — reduce DAI in auctions; by

owe; If no collateral left reduce also by tab (DAI left to pay)- dog.digs — reduce DAI in auctions by rad passed ^dog-digs

- Dirt — total DAI in auctions ^dog-hole-and-dirt

- ilk.dirt — total DAI in auctions for collateral

- dog.digs gh

- when lot == 0 — collateral left to sell after this

take== 0 - why tab + owe — in case no collateral left taker needs to pay all the DAI requested, otherwise only owe

- tab — DAI left to pay

- owe — DAI paid here

- dog.digs — reduce DAI in auctions by rad passed ^dog-digs

if (lot == 0) {— no collateral left- engine.onRemove(usr, tot, 0) — burn fee (in MKR); refund MKR, lsMKR;

urnAuctions[urn]--; — ^LSE-onRemove- burn fee (if collateral left); refund MKR to

urn; mint lsMKR tourn(1:1 as MKR refund); reduce the number of auctions for urn - 1)) in

if (left > 0) {- burn — grossed up fee; in collateral (MKR); no more than

left(collateral left in auction)- “Burn a proportional amount of the MKR which was bought in the auction and return the rest to the

urn.” (from lockstake/README.md) - sold * fee / (WAD - fee) —

feeis grossed-up- why

WAD - fee? — like taxes,soldis post-tax. gross-up- I remember I read about this formula somewhere

- Gross-up amount = desired net pay / (1 – Tax Rate)

- lockstake/README.md “Exit Fee on Liquidation” ^LSC—1-fee

- how is fee set — to a value < WAD

- what is WAD here, 1? — yep, at least for fee

- let’s say we sold 50%

- 0.5 * 0.15 / 0.85 = ~0.088 (burn)

- left 0.5

- refund 0.5 - 0.088 = 0.412

- I think it’s like a tax, to get to 1.765k` more pre-tax. 11765 - 15% = ~10k

- I remember I read about this formula somewhere

- why

- mkr.burn straightforward burn? — yep, just checks for approval or msg.sender == from

- is it old mkr or new? — old

- see mkr = mkrNgt.mkr(); in LSE.constractor

- check the MKR old code — more or less straightforward

-

auth — allows calling

burnfor anyone rn, but can be changed in theory- msg.sender in modifier in public ⇒ msg.sender in modifier in internal

- authority is set, so we go to the last line

function isAuthorized(address src, bytes4 sig) internal view returns (bool) { if (src == address(this)) { return true; } else if (src == owner) { return true; } else if (authority == DSAuthority(address(0))) { return false; } else { return authority.canCall(src, address(this), sig); } } - it looks like it can only be called by admin? — no, see auth.sol. Either owner or

authority.canCall(src, address(this), sig)which allows callingburnto everyone- DSAuthority?

- On mainnet it’s MKRAuthority see etherscan MKR

- It allows calling burn!

function canCall(address src, address, bytes4 sig) public view returns (bool) { if (sig == burn || sig == burnFrom || src == root) { return true; } else if (sig == mint) { return (wards[src] == 1); } else { return false; } }

- DSAuthority?

- burn external (msg.sender == 1) ⇒ burn public(internal) (msg.sender == 1) ⇒ auth (internal) (msg.sender == 1)

- code (same msg.sender everywhere)

// SPDX-License-Identifier: MIT pragma solidity ^0.8.0; import "hardhat/console.sol"; contract SimpleBurnTest { modifier auth { console.log("msg.sender in auth modifier:", msg.sender); _; } function burn(uint256 amount) external { console.log("External burn function called by:", msg.sender); _burn(msg.sender, amount); } function _burn(address guy, uint256 amount) public auth { console.log("Internal _burn function called with guy:", guy); console.log("msg.sender in _burn function:", msg.sender); // Burn logic would go here, but we're omitting it for this test } }

- code (same msg.sender everywhere)

- authority is set, so we go to the last line

- msg.sender in modifier in public ⇒ msg.sender in modifier in internal

- is it old mkr or new? — old

- slip+frob —

increase vat.urns[LSUrn].inkonrefund^LSE-onRemove—slip-plus-frob- vat.slip(ilk, urn, int256(refund)) — increase

urn’sgem(free collateral) onrefund(returned to theurnafter liquidation)- increase gem ^vat-slip

- vat.frob(ilk, urn, urn, address(0), int256(refund), 0); — move collateral (MKR) from

address urn’svat.gem(free collateral) to anaddress urn’svat.urns(vault) ^LSC-kick—vat-frob- How did we get the

gemfor theurn? Why it’s positive? — just above in the slip

- How did we get the

- vat.slip(ilk, urn, int256(refund)) — increase

- “Burn a proportional amount of the MKR which was bought in the auction and return the rest to the

- 2)) (after

if) decrease number of auctions

- burn — grossed up fee; in collateral (MKR); no more than

- burn fee (if collateral left); refund MKR to

_remove(id)— remove fromactive, clearsales[id]^LSC—remove- — remove

idfromactive(active auction ids) and clear insales(id ⇒ struct) _move = active[active.length - 1];— last active auction id- active — stores active auction ids ^LSC-kick—active-push

- active.length - 1 — last element

if (id != _move) {—take(passed by liquidator) is not for the last auction- — id passed by

taker is not last

- — id passed by

_index = sales[id].pos— this auction index inactive- sales — auction id ⇒ struct ^LSC—sales

- sales.pos — Index in

activearray

- rest: swap id with last element, then delete id and

sales[id]

- — remove

} else if (tab == 0) {— have collateral, but no debt- tot; —

lot(collateral) at auction start, ~immutable. ^LSC—sales vat.slip(ilk, address(this), -int256(lot))— reduce gem (free collateral) bylot(amount collateral left to liquidate after currenttake)- why

lot? nottot - lot? — because LC doesn’t want this collateral anymore, debt is covered. Time to return the reset tournin ^LSE-onRemove- probably because we have no debt anymore, collateral should be sent to

urn? — yes, on removeleft - burnFee(~15%)will be sent tourninonRemove. ^LSE-onRemoveleft- burnFee (15% of sold)

- probably because we have no debt anymore, collateral should be sent to

- where will collateral go after? to

urn? — yep

- why

engine.onRemove(usr, tot - lot, lot)— main: burn fee; refund MKR ^LSE-onRemove- args

- usr — Liquidated CDP (urn)

- from ^LSC—sales by

taker providedid

- from ^LSC—sales by

tot - lot— sold in an auctionlot— collateral left (should return to the urn)

- usr — Liquidated CDP (urn)

- slip and frob — ~mint MKR back to the

urnvat.slip— ~mint MKR tovat.gem[ilk][urn]vat.frob— (here)vat.gem[ilk][urn]=(MKR)⇒vat.urns[ilk][usr];Deposit free collateral to the urn

- args

- ^LSC—remove

- tot; —

- engine.onRemove(usr, tot, 0) — burn fee (in MKR); refund MKR, lsMKR;

- Comment

- redo — reset time, price; give reward to keeper ^LSC-redo

- ^LSC—sales

- ^LSC-take—usr-addr0

- reset start time, reset start price to new market price * buffer

- ^LSC-kick—hasReward — if LSC gives rewards (set by admin) && (DAI debt && MKR collateral) both >= dust ⇒ reward keeper (redo ~caller)

if (tab >= _chost && lot * feedPrice >= _chost) {— debt and collateral left >= dust- chost — dust * (1 + penalty), in DAI ^LSC—chost

- tab — auction total in DAI

- yank — cancel auction in dog and here, move MKR to end.sol ⇒ vow.sol ^LSC-yank

- called by

end.snip - ^LSC-take—usr-addr0 — is auction active/exist

dog.digs(ilk, sales[id].tab)— reduce DAI in auctions ^dog-digsvat.flux(ilk, address(this), msg.sender, lot);— move MKR from LSC to caller (end.sol).engine.onRemove(sales[id].usr, 0, 0);— no burn, no mint, no refund. Just reduce counterurnAuctions[urn]--;- ^LSC—remove — remove from

active, clearsales[id]

- called by

- getStatus

- upchost

LockstakeEngine

^LSEngine

-

-

open— Deploy urn; setmsg.senderas the urn’s owner ^LSE-openindex == usrAmts[msg.sender]++— Ensures the urn is created with the last index ^LSE—usrAmtsusrAmts[msg.sender]++usrAmtsis? — Urn counter by userusrAmtsupdated where? — Only inopen++first return value, then increase? — Yep

_initCode()— Code for proxy EIP-1167- https://eips.ethereum.org/EIPS/eip-1167

selfdestructchanged in some EIPs; now it can’t be called — Yep, it still sends all ETH but is destroyed if executed in the same transaction as the contract was created

-

selectFarm— UpdateurnFarms[urn] = farmand move funds to the new farm or LSE ^LSE-selectFarm-

Ensure the urn is not in auction, the farm is approved by Maker, and it’s not the same farm. Move

lsMKRto the farm or LSE, and update storage. urnAuth— Owner or approved ^LSE-urnAuth- How is

urnCanset? — hope/nope byurnAuthed - How are

urnOwnersset? — On ^LSE-open

- How is

- Where does

urnAuctions[urn]change? — OnKick++, onRemove— ^LSE—urnAuctions - What is

farm? — authed; depositlsMKRto receive DAI or subDaoGovs- Deposit

lsMKR→ Choose farm (initially only DAI). Then, receive subDao Gov tokens.

- Deposit

- How is

farms[farm]set and changed? — Approved add/del — ^LSE—FarmStatus- Enum FarmStatus {

- UNSUPPORTED, — Default

- ACTIVE, — Added via

addFarm(authorized) - DELETED — Removed via

delFarm(authorized) }

- Enum FarmStatus {

urnFarms[urn]— Maps urn to farm ^LSE—urnFarms- How is

urnFarms[urn]changed? — InselectFarm, onKick- Only in

_selectFarmselectFarmonKick

- Only in

- On ^LSE-selectFarm, check that

farms[farm] == ACTIVE. - OnKick, it is reset to 0.

farms[farm]is set by authorized actions ^LSE—FarmStatus

- How is

(uint256 ink,) = vat.urns(ilk, urn);— MKR balance for urn ^vat-urns- MKR or

lsMKR? — It should be MKRilk— Probably bytes32 for MKR

- Why

urn? — It should == to MKR, likely just more convenient ^LSE-selectFarm—why-urn-balance- Explanation: It’s probably because

vat.urns[ilk][urn]is always on LSUrn for the user, while MKR can be on LSE or Chief. It belongs to LSE and is mixed with other depositors. urnvs MKRbalanceOf— MKR is on LSE or Chief; urn is on LSUrn- How does

vat.urns[ilk][urn]change with the deposit of MKR?gemis changed using join.join, which transfersgemonjoinand increasesvat.gem.vat.frobcan lockgemto an urn ^LSC-kick—vat-frob and mint DAI.- You can change the amount of DAI wanted using the

dartargument.

- You can change the amount of DAI wanted using the

- It’s possible to move from one urn to another using

vat.fork.

- Explanation: It’s probably because

- MKR or

_selectFarm— Move funds to a new farm (or LSE if nofarmis passed); update the urn’s farm ^LSE-i-selectFarm- Use case for

_selectFarm^LSE-onKick—i-selectFarm wad— Here,ink, collateral amountLockstakeUrn(urn).withdraw(wad)— Withdraw stakedwadof MKR to LockstakeUrn ^LSU-withdrawStakingRewardsLike(farm).withdraw= endgame-toolkit/src/synthetix/StakingRewards.sol::withdraw — Transfer amount tomsg.sender

LockstakeUrn(urn).stake(farm, wad, ref)— Move MKR tofarm, increase the farm’s internal balances ^LSU-stakeupdateReward— Update accumulator and time for all; addrewardsforaccount^SR-updateRewardrewardPerToken— Old value plus accrued interest since the last timeupdateRewardwas calledrewardPerTokenStored—rewardPerTokenon the lastupdateRewardcall

lastTimeRewardApplicable— Now or when the farm finishesearned— Oldrewardsplus newly accrueduserRewardPerTokenPaid— Already paid. AccumulatorrewardPerTokenStored- Updated in

updateRewardeach time reward is moved torewards

- Updated in

- Use case for

-

-

selectVoteDelegate— Move MKR to LSE. Optionally to VD ⇒ VD.chief-

Check: not in auction, VD created by factory, oldVD != newVD, urn is over-collateralized. Move MKR to LSE. Optionally to VD ⇒ VD.chief.

- ^LSE-urnAuth, ^LSE—urnAuctions

- How

voteDelegateFactory.createdis set? — onvoteDelegateFactory.create urnVoteDelegates[urn]⇒ urn ⇒ voteDelegate- Changed on

_selectVoteDelegateselectVoteDelegateonKick

- Changed on

(uint256 ink, uint256 art) = vat.urns(ilk, urn);— collateral MKR, debt DAI for urn ^vat-urnsink— collateral balance, MKRart— debt, DAIurns—urns[ilk bytes32][user address] => Urn{ink(collateral amt, MKR), art(debt DAI)}

(, uint256 rate, uint256 spot,,) = vat.ilks(ilk);— for the line belowvat.ilks— ilk bytes32 ⇒ struct- struct Ilk {

- uint256 Art; // Total Normalized Debt [wad]

- uint256 rate; // Accumulated Rates [ray]

- uint256 spot; // Price with Safety Margin [ray]

- uint256 line; // Debt Ceiling [rad]

- uint256 dust; // Urn Debt Floor [rad]

- }

- struct Ilk {

rate— nDAI to DAI conversion rate ^vat-ilks-rate- Stablecoin debt multiplier (accumulated stability fees). docs

- nDAI to DAI conversion rate

- Multiplier to get DAI from art (nDAI)

spot— asset price in DAI, scaled up by LTV ^vat-ilks-spot- What is the safety margin? — LTV

- Glossary: collateral price with safety margin, i.e., the maximum stablecoin allowed per unit of collateral.

- On vat.file, vat just saves what spot gives

spot.poke— get asset price in DAI, scale up by LTV,vat.fileitrdiv(rdiv(mul(uint(val), 10 ** 9), par), ilks[ilk].mat)— asset price in DAI scaled up by LTV-

Convert asset price in UoV to DAI; increase by liquidation ratio

- GPT simplified:

val / par / ilks[ilk].mat; val, has — fetched from oraclepar— Unit of Value / DAI, e.g., 0.8EUR/DAI- docs “the relationship between DAI and 1 unit of value in the price”

- ^LSC—sales—top—par

- ^LSC-getFeedPrice

val/par

mat— ilk’s liquidation ratio (mat) — lower ⇒ can liquidate

-

- What is the safety margin? — LTV

ink * spot >= art * rate— isOverCollateralized- Exp: collateral value + risk LTV >= debt

ink— collateral amt, MKRspot— collateral price in DAI, scaled up by LTV ^vat-ilks-spotart— debt amt, nDAIrate— nDAI to DAI conversion rate ^vat-ilks-rateink * spot— collateral value in DAI, scaled by LTVart * rate— debt in DAI

_selectVoteDelegate— move MKR to LSE, optionally delegate to VD ⇒ VD.chief. UpdateurnVD[urn] = VDwad=ink= collateral amt onurn, in MKR- Usage in

onKick^LSE-onKick—i-selectVoteDelegate VoteDelegateLike(prevVoteDelegate).free(wad)— return MKR to LSE ^VD-freeVoteDelegateLike(voteDelegate).lock(wad)— MKR: usr ⇒ LSE ⇒ VD ⇒ VD.chiefhatch— locklockfunction for X blocks- GPT: The hatch mechanism provides a buffer period during which no new tokens can be locked, possibly to protect against sudden governance attacks or changes during critical voting periods.

hatchTrigger— whenreserveHatch()was calledHATCH_SIZE— 5, number of blocks to wait afterreserveHatch()is calledHATCH_COOLDOWN— 12, number of blocks to wait until anyone can callreserveHatch()again

- Delegate uses MKR, farm uses

lsMKR^LSE-lockMkrTwice - ^LSE-selectFarm—why-urn-balance

-

-

draw— increaseurn’sdart(nDAI) debt, mint ERC20 NST tourn^LSE-draw- Exp: update and get latest

rate, get latestdart(nDAI) for user-providedwad, createdartdebt for the urn, printdaifor the LSE, convert internaldaito ERC20 NST and send to user- From vat docs (similar function) —

draw: increase Vault debt, creating Dai.

- From vat docs (similar function) —

jug.drip— add virtual profit (stability fees) from loans tovow, return the latestrate(accum to convert nDAI (art) to DAI) ^jug-drip- Exp: updates

rate(accumulator to convert nDAI to DAI debt) - docs: collect stability fees for a given collateral type

- jug docs

- drip

accumulatedFromLastCall=(baseRate + collateralRate)^timePassednewRate=prevRate * accumulatedFromLastCall

- drip

- jug.drip code — add virtual profit from loans to

vowrho— the timestamp of the last fee update- Won’t

(now >= ilks[ilk].rho)revert? — no,>=and is set tonow

- Won’t

vat.fold— add system profit from fees on borrowing tovow- Update

ilk.rate— accumulator of fees - Increase

daifor user — vow’s DAI balance - Increase

debt— system-wide debt of all users, sum ofdai

- Update

- Exp: updates

- Why do we need to call

jug.drip? — Simple, to get the latestrate- Looks like otherwise user loses money somehow

- scReadme says:

wipeAlland `wipe do not drip because it is actually not convenient for the user to do a drip call on wiping. Then, if we force the drip, we are incentivizing users to repay directly to the vat (which is possible) instead of using the engine for that. We are mimicking the old proxy actions behavior, where we drip for drawing, as otherwise the user can lose money, but not forcing the drip on wiping so users actually use this function.

- scReadme says:

- Docs for drip

drip(bytes32 ilk)performs stability fee collection for a specific collateral type when it is called (note that it is a public function and may be called by anyone).dripdoes essentially three things:- Calculates the change in the rate parameter for the collateral type specified by

ilkbased on the time elapsed since the last update and the current instantaneous rate (base + duty); - Calls

Vat.foldto update the collateral’srate, total tracked debt, and Vow surplus; - Updates

ilks[ilk].rhoto be equal to the current timestamp.

- Calculates the change in the rate parameter for the collateral type specified by

- Looks like otherwise user loses money somehow

dart— usually diff inart, nDAI- Why

_divup? —dartis debt, in favor of protocol to increase itwad— amt of daidartis debt, so we want to round in favor of the protocol, increasing the user’s debt

vat.frob(ilk, urn, address(0), address(this), 0, int256(dart));— increase urn’sdart(debt), increasedai(internal ERC20 DAI balance) for LSE ^LSE-draw—vat-frob- ^vat-frob

- //args: i,u,v,w,dink,dart

- Modifies

urn,- Using no

gem(uservis 0,dinkis 0) - Creating

daifor useraddress(this)

- Using no

nstJoin.exit(to, wad);— lock user’s DAI (not debt) internalvat.daibalance onNstJoin, mint NST to the user — ^NstJoin-exitnst/README.md- Says ~the same as

DaiJoinDaiJoin- allows users to withdraw their Dai from the system into a standard ERC20 token. docs

- Says ~the same as

vat.move(msg.sender, address(this), RAY * wad);— transfer DAI frommsg.sendertoaddress(this)- Transfer DAI from, to, amt ^vat-move

- What is

vat.dai? — Basically DAI balance, debt is inurn

- Exp: update and get latest

-

wipe— burnmsg.sender’s NST, decreaseurn’s debt ^LSE-wipe- Explain:

- Get NST from the user

- Burn it on

NstJoin - Decrease urn’s debt

- ~

vat.wipe— decrease Vault debt, destroying Dai.

- Explain:

-

wipeAll— burnmsg.sender’s NST, decreaseurn’s debt ^LSE-wipeAll- Explain:

- Get all debt in DAI

- Get NST (1:1) from

msg.sender - Convert to

vat.dai(burn NST, addvat.dai) - Decrease

urn’s debt

(, uint256 art) = vat.urns(ilk, urn);—urn’s nDAI debtwad = _divup(art * rate, RAY);— convert to DAI- Debt, that’s why up

- Explain:

-

lock— deposit MKR to LSE; mintlsMKRtoLSUrn; optionally delegate (move) MKR, stakelsMKR^LSE-lock- MKR:

msg.sender⇒ LSEngine ?⇒ VoteDelegate ⇒ Chief code, docs - Mint

lsMKR1:1 ⇒LSUrn?⇒ StakingRewards _lock— transfer-delegate MKR, increaseLockstakeUrn’s collateral (MKR) balance on Vat, mintlsMKR1:1 toLockstakeUrn, stakelsMKR-

MKR: LSE ⇒ VoteDelegate ⇒ Chief code, docs + ^LSE—mkr-flow

-

lsMKR: (mint) ⇒LockstakeUrn⇒ StakingRewards ^LSE—lsMkr-flow - How is

urnOwners[urn]set? — onopentomsg.sender, won’t change urnVoteDelegates[urn]— onselectVoteDelegate, checked byvoteDelegateFactory.createdvat.slip— increase gem ^vat-slipvat.frob(ilk, urn, urn, address(0), int256(wad), 0)— move collateral (MKR) fromaddress urn’svat.gem(free collateral) toaddress urn’svat.urns(vault) ^LSC-kick—vat-frob- Change only

dink(collateral) ofurn. Increase - Why

urnif it should be user? — By defaulturnHandler, but can bemsg.sender/approved too. HereLockstakeUrnis the owner- It can be either user or

urnHandler(deployed for each CDP, seeopenin DssCdpManager) - By default, without CDP, one user ⇒ one urn per ilk.

- CDP deploys

urnHandler⇒ can have more than one

- CDP deploys

- It looks like here

LockstakeUrnis the owner ofvat.urn

- It can be either user or

vat.frob(bytes32 i, address u, address v, address w, int dink, int dart)— modifiesurnof useru, usinggemfrom uservand creatingdaifor userw^vat-frob-

“Vaults are managed via

frob(i, u, v, w, dink, dart), which modifies the Vault of useru, usinggemfrom uservand creatingdaifor userw.” docs i— ilk, collateral typeu— owner of modifiedurnv— owner of modifiedgem(collateral)w— owner of modifieddai(DAI internal balance)dink— diff collateral, +-dart— diff nDAI +-

-

- Change only

slip+frob— increasevat.urnsurncollaterallsmkr.mint— mint LST/LP tokens 1:1lsmkr=lockstake/src/LockstakeMkr.sol- What is it? — probably LP/LST tokens, 1:1

urnFarms[urn]— on ^LSE-selectFarm, checked thatfarms[farm] == Activefarms[farm]is set by authed ^LSE—FarmStatus

- ^LSU-stake

-

- MKR:

-

lockNgt— NGT converted to MKR, then ^LSE-lockmkrNgt.ngtToMkr(address(this), ngtWad);— burn NGT, mint MKR

-

free— burnlsMKR, burn 15% fee MKR, return the rest ^LSE-free_free(urn, wad, fee)— burnurn’s stakedlsMKR, burnurn’s MKR onvat, withdraw MKR from VD and burn 15% fee- Fee — oh, it’s 15% on unstake

urnFarms— ^LSE—urnFarms- ^LSU-withdraw

- When did

urngive allowance forlsMKRto LSE? —LSU.init vat.frob(ilk, urn, urn, address(0), -int256(wad), 0);— free collateral from anurn.inktogem- Related ^LSC-kick—vat-frob

- Move collateral (MKR) to

address urn’svat.gem(free collateral) from anaddress urn’svat.urns(vault)

vat.slip(ilk, urn, -int256(wad));— decreasegem— ^vat-slipfrob+slip— burn collateral onvat^LSE-free—frob-plus-slipVoteDelegateLike(prevVoteDelegate).free(wad);— returnwadMKR toLockstakeEngine— ^VD-freechief.free— returnwadMKR to VoteDelegate- code ⬇︎ deposit, ⬇︎votes, burn IOU, return GOV (MKR)

- Weight? — number of tokens = deposits = votes

- Weights = deposits = GOV (MKR) tokens locked on the contract

- subWeight gh — reduce

approvalsfor eachyay(candidate) - Chief docs

yays— candidates/addresses of possible chiefsslates— sets of candidates, so you can vote for severalapprovals— how much each candidate gets- One user can choose multiple

yays(using slate). Eachyaywill getweightamount.- E.g., user has weight 10. Votes for 1

yay. 1yaygets 10 votes. Votes for 10yays, each gets 10 votes - So a user can vote for only one slate, but a slate has several

yays. In that case, eachyaywill get the same number of votes = deposited tokens. It won’t be split.

- E.g., user has weight 10. Votes for 1

- Weight? — number of tokens = deposits = votes

- Chief docs “Charges the user

wadIOUtokens, issues an equal amount ofGOVtokens to the user, and subtractswadweight from the candidates on the user’s selected slate. Fires aLogFreeevent.”

- code ⬇︎ deposit, ⬇︎votes, burn IOU, return GOV (MKR)

- Burn fee 15%

-

freeNgt— same asfree, but convert (mkrNgt.mkrToNgt) to NGT -

freeNoFee— same, but 0 fee burned, authed -

getReward— transfer accrued rewards from SR toto, inrewardsToken- ^LSE—FarmStatus

LockstakeUrn(urn).getReward(farm, to);— getReward from SR inrewardsToken, then transfer all LSU balance toto(caller provided)StakingRewardsLike(farm).getReward();— transfer accrued rewards tomsg.sender- ^SR-updateReward

rewards[msg.sender];— latest accrued rewards, updated inupdateRewardsmodifier

-

Public vars

sdai/SNst

- UUPSUpgradeable

- docs

- code

- top comment

- UUPS proxy — regular proxy with upgrade functionality on the implementation instead of in the proxy itself

- ERC1967Proxy — basically just a standard slot for the implementation address

- rollback — check that the new implementation allows further upgrades (e.g.,

upgradeTo(address)is not removed)

- rollback — check that the new implementation allows further upgrades (e.g.,

- comment UPGRADE_INTERFACE_VERSION

- This variable was introduced in 5.0. In 4.9.x (and probably prior), the contract had 2 functions:

upgradeToandupgradeToAndCall. The latter one willforceCalleven whendatais empty- If this getter is missing, both

upgradeTo(address)andupgradeToAndCall(address,bytes)are present — if missing ⇒ previous version that had both functions. The current version only hasupgradeToAndCall- why?

- This contract only has

upgradeToAndCall - 4.9.6 does not have

UPGRADE_INTERFACE_VERSION, but has bothupgradeToandupgradeToAndCall

- This contract only has

- why?

upgradeTomust be used if no function should be called- while

upgradeToAndCallwill invoke thereceivefunction if the second argument is an empty byte stringupgradeToAndCallpassesforceCall=truefrom 4.9.0-4.9.6,- upgradeToAndCall ⇒

_upgradeToAndCallUUPS⇒_upgradeToAndCall⇒if (data.length > 0 || forceCall) {

- upgradeToAndCall ⇒

- If this getter is missing, both

- In > 5.0, only

upgradeToAndCall. NoforceCall. Nodata- no call- If the getter returns

"5.0.0", onlyupgradeToAndCall(address,bytes)is present, - and the second argument must be the empty byte string if no function should be called,

- making it impossible to invoke the

receivefunction during an upgrade

- If the getter returns

- This variable was introduced in 5.0. In 4.9.x (and probably prior), the contract had 2 functions:

- onlyProxy — not calling Implementation directly;

getImplementationslot (on Proxy) returns__self⇒ Proxy calls the expected Implementation- !

address(this) == __self(set in constructor, immutable, inside the code) — not self call, direct implementation call ERC1967Utils.getImplementation() (= StorageSlot.getAddressSlot(IMPLEMENTATION_SLOT).value)!=__self— implementation slot on the proxy contract must be set to__self(embedded in Implementation code);- If the implementation you call, that knows its address, written inside the code, understands that it was called from a Proxy, it makes sense to revert if it thinks that calling the same address.

- “Execution of a function through ERC1167 minimal proxies (clones) would not normally pass this test, but is not guaranteed to fail.” Why not guaranteed? — because

getImplementationslot is not usually set on 1167. A second check will return true, 0 !=__self. But it can be set; nothing prohibits it.__selfis address1, e.g., 0x1StorageSlot.getAddressSlot(IMPLEMENTATION_SLOT).valueis usually 0- ⇒

address(this) == __selffalse,address(this)= 0x2__self== 0x1- 0x2 == 0x1 ⇒ false

- ⇒

ERC1967Utils.getImplementation() != __self- getImplementation == 0

__self== 0x1- 0 != 0x1 ⇒ true

- !

- Why do we need to validate

proxiableUUID= slot address on upgrade?- If slots are different, then

onlyProxywon’t work

- If slots are different, then

- “IMPORTANT: A proxy pointing at a proxiable contract should not be considered proxiable itself, because this risks bricking a proxy that upgrades to it, by delegating to itself until out of gas. Thus it is critical that this function revert if invoked through a proxy. This is guaranteed by the

notDelegatedmodifier.”- Proxiable = Logic contract = implementation

- “risks bricking a proxy that upgrades to it”

- Wrong: Proxy1 ⇒ Proxy2 ⇒ Logic

- Original: Proxy ⇒ Logic

- Proxy1 sets the implementation to Proxy2.

- Wrong: Proxy1 ⇒ Proxy2 ⇒ Logic

- “by delegating to itself until out of gas”

- Oh, so Proxy1.slot is set to Proxy2.address

- User ⇒ Proxy1 {storage} ⇒ Proxy2 {Logic}

- User ⇒ P1.f1 ⇒ P1.fallback ⇒ P1.impl.f1 ⇒ P2.f1 ⇒ P2.fallback ⇒ P2.impl.f1 (=P1.impl =P2) ⇒ P2.f1 ⇒…

- Proxy2.fallback is looking for the implementation slot, reads Proxy1.slot == Proxy2.address, calls Proxy2, gets to Proxy2.fallback again

- “Thus it is critical that this function revert if invoked through a proxy. This is guaranteed by the

notDelegatedmodifier.” - User ⇒ P1.f1 ⇒ P1.fallback ⇒ P1.impl.f1 - (notDelegated) -address(this) != __self⇒ true ⇒ revert - address(this) == P1 -__selfP1.impl P2 - P1 != P2 ⇒ true ⇒ revert

_upgradeToAndCallUUPScallsproxiableUUID- User ⇒ P1.utac(P2) ⇒ P2.proxiableUUID ⇒ P2.

_checkNotDelegatedaddress(this)== P2__self= C3- P2 != C3 ⇒ true ⇒ revert

- User ⇒ P1.utac(C3) ⇒ C3.proxiableUUID ⇒ C3.

_checkNotDelegatedaddress(this)== C3__self= C3- C3 != C3 ⇒ false ⇒ ok

- User ⇒ P1.utac(P2) ⇒ P2.proxiableUUID ⇒ P2.

- top comment

- constructor

- why

_disableInitializers— so Logic=Impl is not initialized- docs: “Calling this in the constructor of a contract will prevent that contract from being initialized or reinitialized to any version. It is recommended to use this to lock implementation contracts that are designed to be called through proxies.”

- why is it bad to init a logic, it is used only as a source of code? — can delegatecall to

SELFDESTRUCT, but should not be a problem now, unless in the same transaction. low

- why

- initialize

- initializer — called once

__UUPSUpgradeable_init— empty- chi — interest (profit for lender, loss for borrower)

- gpt: accumulates the interest over time.

- docs: the rate accumulator. This is the always increasing value which decides how much

daiis given whendrip()is called.- related: ^jug-drip

- rho — timestamp for chi

- gpt: the last time the interest was accumulated.

- docs: the last time that drip is called.

- related: ^jug-drip

- nsr — rate

- gpt: determines the rate at which interest accumulates.

- NST Savings Rate

- who calls it in deploy scripts? — deployer, inside

new- Deployer ⇒ ERC1967Proxy —

Proxy=Storage contract - Deployer becomes a ward - Deployer ⇒ ERC1967Proxy (msg.sender = deployer) → impl (msg.sender = deployer)

- drip — mint accrued interest as NST on SNst. From increasing

vow.sin(system debt). Returns new accumulator ^SNst-dripnChi— new accumulator (adds fees since the last update)= _rpow(nsr, block.timestamp - rho_) * chi_ / RAY;=(nsr^(now−rho)) * chi= chi * nsr^timeSinceLastUpdate- Where

- nChi is the new rate accumulator.

- nsr is the NST Savings Rate.

- now is the current timestamp.

- rho is the timestamp of the last interest accrual.

- chi is the previous rate accumulator.

- RAY is a constant representing 1e27

- now - rho — timeSinceLastUpdate

- nsr — savingsRate

savingsRate^timeSinceLastUpdate— accumulatedMultiplieraccumulatedMultiplier * chi— accumulatedSinceTheStart

- Where

diff— profit since the last update= totalSupply_ * nChi / RAY - totalSupply_ * chi_ / RAY;- which UoV? — NST

- currentProfit - profitOnLastUpdate

vat.suck(address(vow), address(this), diff * RAY);— Increase bad debt onvowbydiffDAI. Increase internalvatDAI balance of SNstnstJoin.exit(address(this), diff);— locksuckedvat.daibalance on NstJoin, mint NST on SNst- Why do we increase

vow.sin?- System minted free DAI

- It will be canceled later from profits

- More details later in ^SNst-Q—vow-sin-cancel

- deposit — lock NST, mint SNst

- shares = assets * RAY / drip(); — shares to mint per NST provided

- assets — NST to spend

- drip — accumulator of profit

- the bigger the accumulator (the more time has passed) → the fewer shares you get → share price goes up

_mint(assets, shares, receiver)— get NST from msg.sender, mint SNst to receiver

- shares = assets * RAY / drip(); — shares to mint per NST provided

- mint — same, but asks for the amount of SNst to get

- withdraw — burn SNst, unlock (transfer) NST

shares = _divup(assets * RAY, drip());— same as drip, but burn more shares_burn— burn shares (SNst), transfer NST

- redeem — same, but provides shares to burn amount, not NST to receive

- Qs

- How

vow.sin(generated indrip) is canceled — mostly from DAI minters’ fees, also liquidations ^SNst-Q—vow-sin-cancel- Users who put collateral (ETH) and minted DAI pay to SNst holders it seems. Basically from

urns? — yes- docs — can be canceled with

daionvow- Sin represents “seized” or “bad” debt and can be canceled out with an equal quantity of DAI using

heal(uint rad)wheremsg.senderis used as the address for thedaiandsinbalances.- Note: Only the Vow will ever have

sin, so only the Vow can successfully callheal. This is because whenevergrabandsuckare called, the Vow’s address is passed as the recipient ofsin. Note that this is contingent on the current design and implementation of the system. - Note:

healcan only be called with a positive number (uint) and willsub(dai[u])along withsubing thesin.

- Note: Only the Vow will ever have

- Sin represents “seized” or “bad” debt and can be canceled out with an equal quantity of DAI using

- How does

daiget onvow? — jug.drip- System Surplus: Occurs from stability fee accumulation, resulting in additional internal DAI in the

Vow. docs - https://docs.makerdao.com/smart-contract-modules/rates-module#stability-fee-accumulation

- ^jug-drip — creates surplus on vow; from fees on borrowers (DAI minters).

- Borrowers need to return more DAI over time, and this additional DAI goes to

vat.dai

- Borrowers need to return more DAI over time, and this additional DAI goes to

- pot.drip — creates debt on vow, gives to Pot; same as SNst

- DAI depositors (lock) get profit. It will be covered from DAI borrowers

- ^jug-drip — creates surplus on vow; from fees on borrowers (DAI minters).

- System Surplus: Occurs from stability fee accumulation, resulting in additional internal DAI in the

- docs — can be canceled with

- Users who put collateral (ETH) and minted DAI pay to SNst holders it seems. Basically from

- How

- public vars

- PERMIT_TYPEHASH

dss-flapper

-

FlapperUniV2

-

user → vow.flap → flapper(Splitter).kick → FlapperUniV2.exec

- exec — simplified: exchange 50% of DAI for MKR, get LPs for them

_getReserves— get the latest reserves, updated frombalanceOf- pair.getReserves() — cached balanceOf

- https://docs.uniswap.org/contracts/v2/reference/smart-contracts/pair#getreserves

- Returns the reserves of token0 and token1 used to price trades and distribute liquidity. See Pricing. Also returns the

block.timestamp(mod2**32) of the last block during which an interaction occurred for the pair. - https://github.com/Uniswap/v2-core/blob/ee547b17853e71ed4e0101ccfd52e70d5acded58/contracts/UniswapV2Pair.sol#L38-L42

- Returns the reserves of token0 and token1 used to price trades and distribute liquidity. See Pricing. Also returns the

- https://docs.uniswap.org/contracts/v2/reference/smart-contracts/pair#getreserves

- pair.sync — save balanceOf to reserves

- https://docs.uniswap.org/whitepaper.pdf

- 3.2.2 sync() and skim()

- To protect against bespoke token implementations that can update the pair contract’s balance, and to more gracefully handle tokens whose total supply can be greater than 2112, Uniswap v2 has two bail-out functions: sync() and skim().

- sync() functions as a recovery mechanism in the case that a token asynchronously deflates the balance of a pair. In this case, trades will receive sub-optimal rates, and if no liquidity provider is willing to rectify the situation, the pair is stuck. sync() exists to set the reserves of the contract to the current balances, providing a somewhat graceful recovery from this situation.

- code: just call

_updatewith balanceOf

- https://docs.uniswap.org/whitepaper.pdf

- pair.getReserves() — cached balanceOf

_getDaiToSell(lot, _reserveDai)— we want to sell exactly 50% DAI→GEM, but it will move the price. So we need to adjust that after the sell to ensure we have 50% DAI, 50% GEM and supply perfect LP amounts, with no returns- lot —

burnpart (set in splitter_ of fixed lot size set by vowvow.bump * Splitter.burn

- comment

- // The Uniswap invariant needs to hold through the swap. — xy=k

- // Additionally, the deposited funds need to be in the same ratio as the reserves after the swap. — first we do a swap to get GEM. Then we want to deposit in exact proportion, without anything left

- // (1) reserveDai * reserveGem = (reserveDai + sell * 997 / 1000) * (reserveGem - bought) — oldK === newK

- 997 because of fee 0.3%

DAI*GEM = (DAI + (sellDai - fee)) * (GEM - boughtGem)- ⇒

DAI*GEM = (DAI + soldDai) * (GEM - boughtGem) - ⇒ oldK === newK

- // (2) (lot - sell) / bought = (reserveDai + sell) / (reserveGem - bought) — Flapper’s DAI and GEM balances (after sale) are equal in value for new UniV2Pool prices

- lot — all DAI

- lot - sell — remaining DAI, ~50%

- ⇒

leftDAI/boughtGEM = newDAI / newGEM - ⇒ leftDAI == boughtGEM in new UniV2 prices

- // The solution for these equations for variables

sellandboughtis used below. —_getDaiToSelltries to solve both (system of equations)

- (Babylonian.sqrt(reserveDai * (lot * 3_988_000 + reserveDai * 3_988_009)) - reserveDai * 1997) / 1994;

- Maybe later in ^FlapperUniV2-formula

- lot —

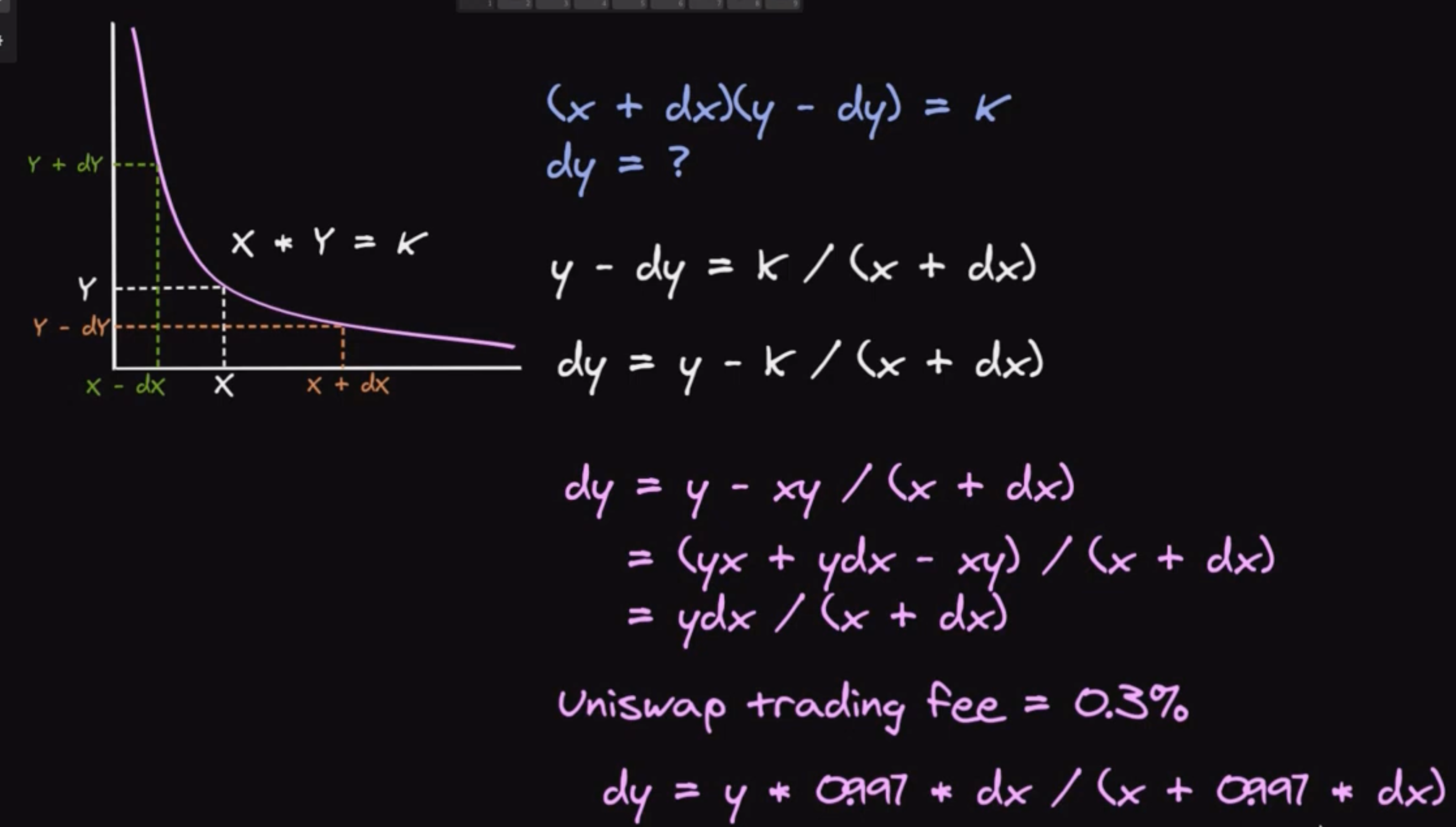

_getAmountOut— rewritten constant product formula(x+dx)(y-dy)=kto getdy^FlapperUniV2—getAmountOut -amtOut = _amtInFee * reserveOut / (reserveIn * 1000 + _amtInFee);- x - DAI, y - MKR/GEM -dy = dx * y / (x + dx)— last on the screenshot - https://www.youtube.com/watch?v=EIIfavUFnM4&t=718s — too basic - https://www.youtube.com/watch?v=IL7cRj5vzEU — good -

- ^FlapperUniV2SwapOnly—sufficient-buy-amount

pair.swap(_amt0Out, _amt1Out, address(this), new bytes(0));— get MKR (DAItransferjust above)- UniswapV2Pair.mint — low-level mint, no returns

- is

_mintFeeset? — not now - Does

mintreturn surplus? — nope

- is

-

-

Splitter

- Qs

- Who calls it? — user → vow.flap → flapper(Splitter).kick

- dss.vow

- vow kicks flop and flap on schema https://github.com/makerdao/dss/wiki

- mom only to stop

- dss.vow

flapperburn DAI? — The underlying burner strategy (e.g., the address ofFlapperUniV2SwapOnly).- burn engine? — probably FlapperUniV2* contracts

hop- Minimum seconds interval between kicks.vow.bump— Flap fixed lot size

- Who calls it? — user → vow.flap → flapper(Splitter).kick

- kick —

vat.dai:vow⇒ Splitter ⇒ DaiJoin =(mint ERC20 DAI)⇒ FlapperUniV2 & Farm; trigger flapper; trigger farmvat.move(msg.sender, address(this), tot);— transfervat.daifrom msg.sender (vow) to Splitter (this)uint256 lot = tot * burn / RAD; if (lot > 0) {when? — when burn is set to 0 (or rounding, but it has vat.bump (minimal lot), so only 0)DaiJoinLike(daiJoin).exit(address(flapper), lot);— lock Splitter’svat.daibalance on DaiJoin, mint ERC20 DAI to flapper(FlapperUniV2*)- code https://github.com/makerdao/dss/blob/master/src/join.sol#L169-L174

- same as ^NstJoin-exit

- How can we have any

vat.daionFlapperUniV2- Surplus

vat.daigoes onvow, when it’s enoughvowcankicksplitter, splitter getsvat.dai - Oh,

.exitgetsvat.daifrommsg.sender, Splitter

- Surplus

- Qs

-

FlapperUniV2SwapOnly — buy MKR for DAI

- exec — just buy MKR, but limit the price by 2% of the oracle’s price

buy >= lot * want / (uint256(pip.read()) * RAY / spotter.par())— buy >= 98% of lot(collateral=MKR) value in DAI ^FlapperUniV2SwapOnly—sufficient-buy-amount- uint256(pip.read()) * RAY / spotter.par()

- priceInUoV / DaiToUov ⇒ priceInDai

- lot — amount to sell, collateral, MKR

- want — 98%, we don’t allow less than that

- pip.read() / spotter.par — get MKR price in DAI

- uint256(pip.read()) * RAY / spotter.par()

- exec — just buy MKR, but limit the price by 2% of the oracle’s price

-

Maybe

_getDaiToSellformula — looks like you need to go too deep and solve a system ^FlapperUniV2-formula- CGpt:

Certainly, I'll explain how the formula in the `_getDaiToSell` function was derived. Let's break it down step by step: 1. First, let's recall the two equations mentioned in the comments: (1) reserveDai * reserveGem = (reserveDai + sell * 997 / 1000) * (reserveGem - bought) (2) (lot - sell) / bought = (reserveDai + sell) / (reserveGem - bought) 2. These equations represent the Uniswap invariant and the ratio of reserves after the swap, respectively. 3. To solve for `sell`, we need to eliminate `bought` from these equations and solve for `sell`. 4. From equation (2), we can express `bought` in terms of other variables: bought = (lot - sell) * (reserveGem - bought) / (reserveDai + sell) 5. Substituting this into equation (1): reserveDai * reserveGem = (reserveDai + sell * 997 / 1000) * (reserveGem - (lot - sell) * (reserveGem - bought) / (reserveDai + sell)) 6. This equation is quite complex, but it can be simplified and rearranged into a quadratic equation in terms of `sell`. 7. After simplification and rearrangement (which involves several algebraic steps), we get a quadratic equation of the form: a * sell^2 + b * sell + c = 0 Where: a = 1994 b = 1997 * reserveDai c = -reserveDai * (lot * 3988000 + reserveDai * 3988009) 8. The solution to this quadratic equation is given by the quadratic formula: sell = (-b + sqrt(b^2 - 4ac)) / (2a) 9. Substituting the values of a, b, and c: sell = (-1997 * reserveDai + sqrt((1997 * reserveDai)^2 - 4 * 1994 * (-reserveDai * (lot * 3988000 + reserveDai * 3988009)))) / (2 * 1994) 10. Simplifying this expression (factoring out reserveDai from under the square root): sell = (sqrt(reserveDai * (lot * 3988000 + reserveDai * 3988009)) - reserveDai * 1997) / 1994 This is exactly the formula we see in the `_getDaiToSell` function: ```solidity sell = (Babylonian.sqrt(reserveDai * (lot * 3_988_000 + reserveDai * 3_988_009)) - reserveDai * 1997) / 1994; ``` The `Babylonian.sqrt` function is used to calculate the square root, and the constants have been slightly adjusted (3_988_000 instead of 3988000) for readability, but the formula is essentially the same. This derivation involves complex algebraic manipulations and simplifications, which is why the resulting formula looks quite different from the original equations. The goal was to find an efficient way to calculate the amount of DAI to sell given the lot size and the current DAI reserve.

- CGpt:

dog.bark

^dog-bark

How does liquidation work here? Funds movement

^funds-movement-on-liquidation

- MKR

- default — seats on LSE or chief after

LSE.lock - dog.bark — chief ⇒ VD ⇒ LSE

-

self: noop; ink to clip

- ^dog-bark

- ^dog-bark—vat-grab

- LSClipper.kick — chief ⇒ VD ⇒ LSE

-

self: noop

- LSE.onKick — chief ⇒ VD ⇒ LSE

-

-

- LSClipper.take — LSE ⇒ taker && LSE ⇒

burn(15% ofsold)- vat.slip — noop; reduce gem

- LSE.onTake — LSE ⇒ providedByTaker

- vat.move — noop; only dai

- dog.digs — noop; global dirt/Dirt

- engine.onRemove — burn 15% of

sold

- default — seats on LSE or chief after

- vat.urn.ink / vat.gem

- default — seats on

vat.urns[LSUrn].ink - dog.bark —

vat.urns[LSUrn].ink-⇒vat.gem[LSClipper]+- ^dog-bark—vat-grab —

vat.urns[LSUrn].ink-⇒vat.gem[LSClipper]+ - LSClipper.kick — noop

- vat.suck — noop

- LSE.onKick — noop

- ^dog-bark—vat-grab —

- LSClipper.take —

vat.gem[LSClipper]-(slice(bought amt)) &&vat.urns[LSUrn].ink+(refund)- vat.slip —

vat.gem[LSClipper]-slice(bought amt) - LSE.onTake — noop

- vat.move — noop

- dog.digs — noop; global dirt/Dirt

- engine.onRemove — increase

vat.urns[LSUrn].inkonrefund^LSE-onRemove—slip-plus-frob

- vat.slip —

- default — seats on

- vat.dai / vat.urn.art / vat.sin

- default — seats on

vat.urns[LSUrn].art - dog.bark —

vat.urns[LSUrn].art-= (dart) >vat.sin[vow]+&&vat.sin[vow]+= (coin) >vat.dai[kpr]+- ^dog-bark—vat-grab —

vat.urns[LSUrn].art-⇒ (vat.gem[LSClip]&&vat.sin[vow]+)- dart = (whole urn or systemLimitLeft)

- LSClipper.kick —

vat.sin[vow]+⇒vat.dai[kpr]+- vat.suck —

vat.sin[vow]+⇒vat.dai[kpr]+ - LSE.onKick — noop

- vat.suck —

- ^dog-bark—vat-grab —

- LSClipper.take —

vat.dai[taker]= (owe) >vat.dai[vow]- vat.slip — noop

- LSE.onTake — noop

- vat.move —

vat.dai[taker]= (owe) >vat.dai[vow]- owe = paid

- dog.digs — noop; global dirt/Dirt

- engine.onRemove — noop

- default — seats on

- lsMKR

- default — on LSUrn or Farm

- dog.bark — Farm = (dink) > LSUrn = (dink) >

burn- amt: dink (dog.bark) ⇒ lot (kick) ⇒ wad (onKick)

- ^dog-bark—vat-grab — noop

- LSClipper.kick — Farm ⇒ LSUrn ⇒

burn- vat.suck — noop

- LSE.onKick — Farm ⇒ LSUrn ⇒

burn

- LSClipper.take —

mint= (refund) > LSUrn- vat.slip — noop

- LSE.onTake — noop

- vat.move — noop

- dog.digs — noop

- engine.onRemove —

mint= (refund) > LSUrn

- DAI — mints in DaiJoin.exit using vat.move (change vat.dai[src] ⇒ [dst])