Code walkthrough

-

Terms

--— comment- r — require

- U — underlying

- m.s — msg.sender

- xX — invalid thought

~— by default; or assumed to be, but not necessary true; Most often it means that in the code it is called by some contract, but there is no access control, so it can be called by someone else

-

LoanNFT

-

openLoan/openEscrowLoan

_openLoan— pull underlying, swap for cash, keep maxLoss on takerNft, mint LoanNft and give unloosable cash to the borrower ^LNft---openLoan- — summary

- validations

- pull underlying + escrowFee from borrower

- (optional) mint escrowNft to funds provider using funds from escrow.offerId (borrower-provided id)

- also `escrowNft.offers[id].available -= underlyingAmt

- funds stay on LoansNft always, escrow just get a fee, escrow is probably used just for tax reasons

- mint CTakerNft to LoansNft, CProviderNft on

.liquidityOffers[ProviderOffer.id].provider- swap underlying → cash

- keep max loss for taker on CTakerNft contract, from swap money

- keep max win for taker on CProviderNft contract, from

CProviderNft.liquidityOffers[ProviderOffer.id]

- mint LoansNft to borrower

- Params

- underlyingAmount ^LNft---openLoan—underlyingAmount

- pulled from borrower(msg.sender) with escrowFee

- set as escrowed on ^ESNft---startEscrow

- transfered from LoansNft and immedieately back

- on

_swapAndMintCollarexchanged to cash- maxLoss is kept

- everything else is sent to the borrower

- stored on LoansNft.loans.underlyingAmount

- maybe something else, but only interested in above

- underlyingAmount ^LNft---openLoan—underlyingAmount

require(configHub.canOpenPair(underlying, cashAsset, address(this)), "");— is WhiteListed? enumerable set, updated by owner of ConfigHubescrowFee = usesEscrow ? escrowFee : 0;— later, see also ^LNft-q1underlying.safeTransferFrom(msg.sender, address(this), underlyingAmount + escrowFee);— pull collateral/underlying from msg.sender (borrower)_conditionalOpenEscrow(usesEscrow, underlyingAmount, escrowOffer, escrowFee);mint ESNft for escrowSupplier + creates a new escrow; keeps only escrowFee ^LNft---conditionalOpenEscrow- — summary

- validations

- mint ESNft to ESNft.offer.supplier; starts a new escrow using funds from offer.id or part of it

- transfer funds from LoansNft to ESNft, then

escrowedback to LoansNft. Basically keep only the escrowFee

escrowNFT = offer.escrowNFT;— offer is userProvidedescrowNFTchecked in ^LNft---conditionalOpenEscrow—canOpenSingle below

require(escrowNFT.asset() == underlying, "");- EscrowSupplierNFT.asset() is immutable in original contract

require(configHub.canOpenSingle(underlying, address(escrowNFT)), "");— make sure whitelisted by configHub.owner ^LNft---conditionalOpenEscrow—canOpenSingleunderlying.forceApprove(address(escrowNFT), escrowed + fee);— rewrite approval to a new value; On revert calls .approve(0) and .approve(X) again ^OZ-ERC20-forceApproveescrowId = escrowNFT.startEscrow({ offerId: offer.id, escrowed: escrowed, fee: fee, loanId: takerNFT.nextPositionId() });— mint ESNft to ESNft.offer.supplier; starts a new escrow using funds from offer.id or part of it

- — summary

(takerId, providerId, loanAmount) = _swapAndMintCollar(underlyingAmount, providerOffer, swapParams);— swap, mint NFTs, arrange funds ^LNFT---swapAndMintCollar- — summary

- validations

- swap underlying → cash, validate diff price ⇐10% from oracle

- split cashFromSwap on

- loan — amount to send to the borrower, == put strike price (the position can’t get below it);

- takerLocked — funds at risk, will be kept on the contract just in case

- create paired taker-provider NFTs, provider locks max profit that taker can get from the collar. LoansNFT >-(

takerLocked)-CTakerNft

- all params are user-provided

configHub.canOpenPair(underlying, cashAsset, address(takerNFT)/providerNFT— whitelist check- underlying — GPT: == collateral

- cashAsset — GPT: == borrowed asset

- takerNFT — borrower

- providerNFT — LP

- underlyingAmount != 0 — collateral requested to be used by caller (opener/borrower) is not 0. So the position can’t have no collateral, at least not on

open uint cashFromSwap = _swap(underlying, cashAsset, underlyingAmount, swapParams)— swap underlyingAmount to cashAsset using borrower-provided swapper ^LNft---swapallowedSwappers[swapParams.swapper]— white-listed by owner of LoansNftuint balanceBefore = assetOut.balanceOf(address(this));— for diff- How come we have a balance here? (for

_swapAndMintCollar) — Maybe we don’t, just to make sure we use diff and no one force fed the contract

- How come we have a balance here? (for

assetIn.forceApprove(swapParams.swapper, amountIn);— 1-3 calls intoassetIn, ^OZ-ERC20-forceApprove- ISwapper(swapParams.swapper).swap(

- is swapper whiteListed? — no, anyone

amountOut == amountOutSwapper— both swapper reply and balanceOf diff matchamountOut >= swapParams.minAmountOut— protection against sandwich or just bad exchange rate

_checkSwapPrice(cashFromSwap, underlyingAmount);— check the change from oracle ⇐ 10%- ITakerOracle oracle = takerNFT.oracle(); — request oracle from immutable contract takerNFT. Oracle can be set by takerNFT’s owner

uint underlyingFromCash = oracle.convertToBaseAmount(cashFromSwap, oracle.currentPrice());— convert back using oracle- oracle.convertToBaseAmount — rounds down; quoteTokenAmount x precision / atPrice

- oracle.currentPrice — mostly just latestRoundData, but can be more complex

uint absDiff = a > b ? a - b : b - a;— absDiff, correctuint deviation = absDiff * BIPS_BASE / underlyingAmount; require(deviation <= MAX_SWAP_PRICE_DEVIATION_BIPS,"...")— require deviation ⇐ 10%- BIPS — 10_000

- MAX_SWAP_PRICE_DEVIATION_BIPS — 1000

- deviation —

- basically diff/amount percents, how big is diff comparing to amounts

- if 10% 10x10k/100=1k

- if 1% 100

- 9x10k/90k is the limit

- rounds down on ~1BIP = 0.01%

- comment above ltvPercent — basically sent some cash to borrower, and keep some on taker

- GPT: Understanding Loan Creation A Breakdown of the Code Snippet

- // split the cash to loanAmount and takerLocked — cash ⇒ loanAmount, takerLocked

- // this uses LTV === put strike price, so the loan is the pre-exercised put (sent to user) in the “Variable Prepaid Forward” (trad-fi) structure.

- Summary: immediately get cash for your collateral, using LTV cash per collateral put strike price per collateral

- LTV — loan-to-value == underlying/collateral to cash/borrowed

- put strike price — right to sell underlying for a specific price

- for put buyer: the right to sell for a specific price; OOM if the price above, because can sell on the market with more profit

- for put writer: the obligation to buy at a specific price

- buyer is bearish, writer is bullish

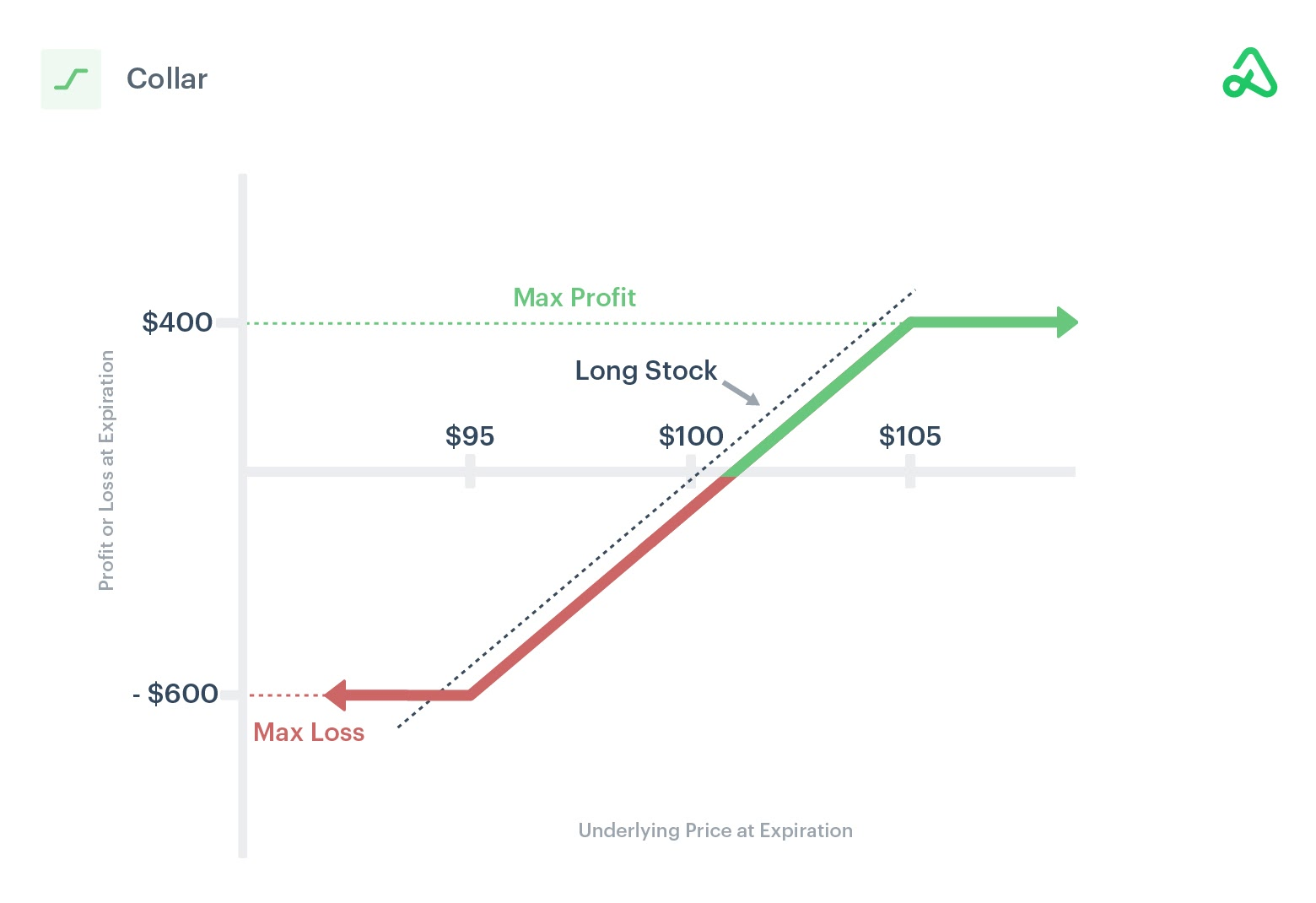

- Variable Prepaid Forward — buy put, to protect against price fall below X; Sell call to get cash now, but loose some upside. E.g.

[85; 220]collar from Cuban. Can’t make more than 220, can’t loose more than 85. Also has a date, so not a taxable event (arguably/depends) until settled; Basically_/ ̄shape- https://docs.collarprotocol.xyz/collar-primer/further-reading/

- https://www.investopedia.com/terms/v/variable-prepaid-forward-contracts.asp

- https://www.forbes.com/sites/robertwood/2021/05/29/money-now-taxes-later-with-prepaid-forward-contracts/

- https://markets.businessinsider.com/news/stocks/how-mark-cuban-saved-billions-yahoo-windfall-dot-com-crash-2020-6-1029303375

- Collar —

- https://docs.collarprotocol.xyz/collar-primer/further-reading/

- loan is the pre-exercised put (sent to user) — sold collateral and got cash

- GPT: The Loan as a Pre-Exercised Put Option

- pre-exercised probably == early exercise

- So we exercise the put (right to sell) == sell underlying, get cash

- LTV === put strike price — probably means that if it was a put, it would have for the same X of cash and 1 unit of collateral ⇒ X strike price, for 1 unit collateral

- The Collar paired position NFTs implement the rest of the payout. — 2 NFTs: 1 for lender, 1 for borrower, somehow paired

- paired position NFTs — One for lender, one for borrower

- uint ltvPercent = providerNFT.getOffer(offerId).putStrikePercent; — just read value set by offer creator (LP,/lender)

- providerNFT.getOffer(offerId)

- created on ^CProviderNFT-createOffer

- updates amounts on

updateOfferAmountandmintFromOffer

- .putStrikePercent

- Set on ^CProviderNFT-createOffer, putStrikePercent ⇐ MAX_PUT_STRIKE_BIPS

- providerNFT.getOffer(offerId)

loanAmount = ltvPercent * cashFromSwap / BIPS_BASE; uint takerLocked = cashFromSwap - loanAmount;— cash ⇒ loanAmount, takerLockedcashAsset.forceApprove(address(takerNFT), takerLocked);— allowtakerNFTcontract to pull cash from LoansNft(takerId, providerId) = takerNFT.openPairedPosition(takerLocked, providerNFT, offerId);— mint CProviderNft, mint CTakerNft, pulltakerLockedfrom caller (LoansNft, Rolls) ^CTakerNFT-openPairedPosition- — summary:

- a lot of validations

- mint CProviderNft using offer, pay protocol fees

- mint CTakerNft, pull

takerLockedfunds from LoansNft

takerLocked— maxLoss: all U in cash - putStrike (sentToBorrower) ^CTakerNFT-openPairedPosition—takerLocked- — calculated from LP provider set

putStrikePercent, up to 100% - — locked on borrower, funds received on swap of collateral to cash, some cash sent back as loan

- —

cashFromSwap - loanAmount, collateral value - sent to borrower

- —

- takerLocked = cashFromSwap - loanAmount = cashFromSwap - putStrikePercent x cashFromSwap = cashFromSwap (1 - putStrikePercent)

- loanAmount =

ltvPercent * cashFromSwap— = putStrikePercent x cashFromSwap- ltvPercent = putStrikePercent

- loanAmount =

- — calculated from LP provider set

providerNFT— kind of verified byconfigHub.canOpenPair(underlying, cashAsset, address(providerNFT))that whitelisted for this Underlying-CashAssetofferId— not yet verified- configHub.canOpenPair x 2 — check again that

thisandproviderNFTwhitelisted require(providerNFT.underlying() == underlying,require(providerNFT.cashAsset() == cashAsset— verify both assets matchCollarProviderNFT.LiquidityOffer memory offer = providerNFT.getOffer(offerId); require(offer.duration != 0, "taker: invalid offer");— verify offer is set (would be 0 otherwise)uint providerLocked = calculateProviderLocked(takerLocked, offer.putStrikePercent, offer.callStrikePercent);— callStrike - spot; max profit for taker, will probably be paid by provider ^CTakerNFT-openPairedPosition—providerLocked- — I think the main idea is if the price goes up to the moon taker can win up to

callStrike - spot, and someone needs to pay them. It will be provider - taker — borrower

- GPT: Breaking Down `calculateProviderLocked` Function

- Good to understand https://docs.collarprotocol.xyz/collar-primer/example-trade/, point 2, $200 collateral

- uint putRange = BIPS_BASE - putStrikePercent; — how much price is allowed to fall, in bps, {1pbs; 1x); taker: max loss; LP: drop before loss

- — How much max the taker can loose from current price, percents

- — How much the price can change until LP will start to loose money

- 100% - X%, X is strictly < 10_000 on ^CProviderNFT-createOffer

- putStrikePercent ⇐ MAX_PUT_STRIKE_BIPS; MAX_PUT_STRIKE_BIPS = BIPS_BASE - 1;

- putStrikePercent — set on the LP offer by creator

- uint callRange = callStrikePercent - BIPS_BASE; — how much price is allowed to grow, in bps, {1bps;9x}; taker: max win; LP: rise before gain

- — How much max the taker can win from current price, percents

- — How much the price can change up until LP will start to gain profit

- callStrikePercent — set on the LP offer by creator

- Maybe how much the price can rise above the current price

- X% - 100%

- X ∈ {10_001; 100_000} ⇒ diff ∈ {1bps; 9x}

takerLocked * callRange / putRange— amt x (callStrike - spot)- — rise before gain in collateral/underlying amount = diff between spot and call strike = callStrike - spotPrice

- — the higher the callStrike the more collateral is required

- ^CTakerNFT-openPairedPosition—takerLocked — cashFromSwap x (1 - putStrikePercent)

- cashFromSwap x (1 - putStrikePercent) x callRange / (1 - putStrikePercent) = cashFromSwap x callRange = amt x spotPrice x riseBeforeGain = amt x rise before gain in collateral(=underlying) amount

- cashFromSwap x (callStrikePercent - 1) = spot x callStrikeIn% - spot = callStrike - spot = maxProfit (for taker)

callRange / putRange— grow until profit / drop until loss- {1bps; 9x} / {1pbs; 1x)

- Examples call/put

- range: 9x/~1x; %: 1000%/0.01%

- spot $1k

- call $10k

- put $1k

- providerLocked ~9x of taker

- takerAmount 1bps of strike

- 0.1x/0.1x; %: 110%/90%

- spot $1k

- call $1.1k

- put $0.9k

- provider locked 1x of taker

- takerAmount 90% of strike

- 2.1x/0.7x; %: 310%/30%

- spot $1k

- call $3.1k

- put $0.7k

- provider locked 3x of taker

- takerAmount 30% of strike

- range: 9x/~1x; %: 1000%/0.01%

- Thoughts

- To issue the collar option LP need to have collateral. What is the max loss? —

-$1000or the put price- Call for writer — obligation to sell for strike price, bearish, hope the price will go below strike, so no one will execute the call

- Call for buyer — right to buy at strike price, bullish, will be able to buy below market

- Put for writer — obligation to buy for strike, bullish, hope the price will go above strike, and no one wants to sell for cheap put strike

- Put for buyer — right to sell at strike, bearish, will be able to sell above market

- Who is writer, who is buyer here? — taker: buy put, write calll; LP: write put, buy call

- Collar strategy: buy put, sell call; For taker

- Taker: buys put, sells call

- Has a right to buy at put strike, has obligation to sell at call strike

- Collateral required for 1 unit

- put (right to sell) $1000

- call (obligation to sell) $1100

- Got cash from selling call

- bearish case:

- price drops to $0,

- call OTM — no customers for taker: why buy for $1.1k if can get for free on the market

- put ITM — taker executes: why sell for free if can get $1k

- buys on the market for 1000;

- OR sells their collateral for $1000; otherwise would loose all

- Balance: $1000

- bullish case:

- price goes to $2000,

- call ITM — everyone wants to buy for $1.1k, market is so high

- put OTM — taker ignores: why sell for 2k

- Balance: $1100

- best case(bear): $1000;

- worst case(bull): -$100

- and also has a collateral that looses current price on bear, and unlimited upside on bull

- Let’s now check not just a collar, but collar + collateral

- bear, price drops to $0

- put +$1000;

- call $0;

- result: +$1000

- bull, price up to $2k

- put $0

- call +$1100

- result +$1100

- Note: would be +$2k if no call, but needed cash

- bear, price drops to $0

- Maker/LP: sells put, buys call

- Collateral required for 1 unit

- put (obligation to buy) $1000

- call (right to buy) $1100

- Got cash from selling put

- bearish case:

- price drops to 0,

- call OTM, — $0

- put ITM, — -$1000

- looses $1000

- bullish case:

- price goes to $2000

- call ITM, — +$900, but unlimited upside

- put OTM, — $0

- unlimited profit

- Collateral required for 1 unit

- Why putStrikePercent = ltvPercent?

- GPT: Put Strike Percent as Loan-to-Value (LTV)

- Design choice. So basically put is a guaranteed profit. We can give it instantly. That’s our Value in LTV

- To issue the collar option LP need to have collateral. What is the max loss? —

- providerLocked usage

- — I think the main idea is if the price goes up to the moon taker can win up to

- uint startPrice = currentOraclePrice();

(uint putStrikePrice, uint callStrikePrice) = _strikePrices(offer.putStrikePercent, offer.callStrikePercent, startPrice);— convert to absolute valuesputStrikePrice < startPrice && callStrikePrice > startPrice— {put < spot < call}- ^CProviderNFT-mintFromOffer — mint providerNFT to provider, save data on it

uint expiration = block.timestamp + offer.duration; require(expiration == providerNFT.expiration(providerId)— check expiration match, uses the same formulapositions[takerId] = TakerPositionStored({...; _mint(msg.sender, takerId);— save data, mint takerNFT to msg.sender (LoansNFT)cashAsset.safeTransferFrom(msg.sender, address(this), takerLocked);— safe maxLoss on CTakerNFT contract- on swap they got assets on LoansNFT, now we pull part that not for borrower, that depends on putStrike, the one that can be lossed == max loss

- — summary:

- — summary

- r

loanAmount >= minLoanAmount _newLoanIdCheck— .underlyingAmount == 0- loanId = takerId; — takerNFT’s id, basically a loan id

if (usesEscrow) _escrowValidations(loanId, escrowNFT, escrowId);— loanIds, expiration of loanId match- mint loanNft, store data, send loan cash to borrower

- — summary

-

forecloseLoan

- Summary

- Validations

- Burn LoansNft

- Burn takerNft, withdraw all (maxLoss in cash) from it

- Swap it for U

- Return escrowed U to Escrow + fees

- U on LoansNft from

openEscrowLoan

- U on LoansNft from

- And all the profit to borrower

- only escrowed

_isSenderOrKeeperFor(escrowOwner)— isSenderEqOwner || (keeperApprovedBySender && isKeeper)- only owner of the loanNft token

- or closingKeeper set by LoansNft contract owner

- but to set

keeperApproved[msg.sender]only

- but to set

uint gracePeriodEnd = _expiration(loanId) + escrowGracePeriod(loanId);—_expiration(loanId)— simple storage read from takerNft→providerNft ^LNft---expiration- set on ^CProviderNFT-mintFromOffer

escrowGracePeriod(loanId)— timeAfforded paid from takerLocked(for maxLoss). capped from both min and max sides- convert

cashAvailable = takerPosition.withdrawableto underlying loan.escrowNFT.cappedGracePeriod(loan.escrowId, underlyingAmount)— timeAfforded paid from takerLocked(for maxLoss). capped from both min and max sides ^ESNft-cappedGracePeriod- uint timeAfforded = maxLateFee * YEAR * BIPS_BASE / escrow.escrowed / escrow.lateFeeAPR; — get max fees takerPosition can pay from takerLocked(maxLoss), convert it to time

- takerPosition.withdrawable, how does it change? ^CTakerNft-positions—withdrawable

- set to 0 on

openPairedPosition - set to takerBalance on

settlePairedPositiontakerLocked(maxLoss) + P&L current collar value (on settle) - set ot 0 on

withdrawFromSettled

- set to 0 on

- maxLateFee underlyingAmount withdrawable cash from taker position converted to underlying == free funds we can spend

- Comment

- Calculate the grace period that can be “afforded” by maxLateFee according to few APR. — basically because maxLateFee is set, not time, we need to calculate the time back from the fee

- fee = escrowed * time * APR / year / 100bips, so

- escrowed — ^ESNft---startEscrow—escrowed

- time — in seconds. It will be moved to the left of the formula below; Or == all the other vars will be moved to the left, then reverse the formula

- time = fee * year * 100bips / escrowed / APR; — got it from the fee formula above

- takerPosition.withdrawable, how does it change? ^CTakerNft-positions—withdrawable

- return one of (MIN_GRACE_PERIOD; timeAfforded; escrow.maxGracePeriod)

- uint timeAfforded = maxLateFee * YEAR * BIPS_BASE / escrow.escrowed / escrow.lateFeeAPR; — get max fees takerPosition can pay from takerLocked(maxLoss), convert it to time

- convert

- r

block.timestamp > gracePeriodEnd— only after gracePeriod and can’t pay grace fees, between 1 day and set by escrow owner _burn(loanId);— burn the LoanNftuint cashAvailable = takerNFT.withdrawFromSettled(_takerId(loanId));— get all withdrawable (on settle set to takerLocked(maxLoss) + P&L == current collar value) fromtakerNft[id]; burn CTakerNft; ^LNft-forecloseLoan—cashAvailable- onlyOwnerOf(takerId), only settled position

- withdrawable was set on? — See ^CTakerNft-positions—withdrawable, on settle set to takerLocked(maxLoss) + P&L == current collar value (on settle)

positions[takerId].withdrawable = 0;_burn(takerId);cashAsset.safeTransfer(msg.sender, withdrawal)— transfer all to LoanNFT

- swap cash to underlying, see ^LNft---swap

uint toBorrower = _releaseEscrow(escrowNFT, escrowId, fromSwap);— Escrow allowed to withdraw (funds from LoansNft); change goes to borrower ^LNft---releaseEscrow- — ESNft released=true and withdrawable = debt(.escrowed) + fee + lateFee (most of the time debt x time x fee%); Funds sent from LoansNft;

- — profit from swap (U went down badly) or leftOver (U did not sink) goes to borrower

- Note: below notes most of the time from

forecloseLoanpath, the function and inner function can be called with different values by other functions escrowNFT.currentOwed(escrowId)— debt(.escrowed) + lateFee{ (debt x time x fee%); 0 if still MIN_GRACE_PERIOD }getEscrow(escrowId);— simple read from storageESNft._lateFee— grace ⇒ 0; default ⇒ debt x time x fee% ^ESNft---lateFeeblock.timestamp < escrow.expiration + MIN_GRACE_PERIOD— still in grace period ⇒ 0- escrow.expiration — set on ^ESNft---startEscrow (start/switch)

- MIN_GRACE_PERIOD — 1 day

Math.ceilDiv(escrow.escrowed * escrow.lateFeeAPR * overdue, BIPS_BASE * YEAR)— debt x time x fee%- Somewhat similar formula to ^ESNft-cappedGracePeriod

- debt x time x fee

- set on ^ESNft-createOffer, max 12%/year (12 bips)

- uint toEscrow = Math.min(fromSwap, totalOwed); —escrow.escrowed + lateFee capped ^LNft---releaseEscrow—toEscrow

escrowNFT.endEscrow(escrowId, toEscrow);— update escrow: released = true, withdrawable = owedCappedByAvailable; pull toEscrow from LNft;- repaid = toEscrow = ^LNft---releaseEscrow—toEscrow

_endEscrow(escrowId, getEscrow(escrowId), repaid)— update escrow: released = true, withdrawable = owedCappedByAvailable ^ESNft---endEscrow- Note: reviewed for forecloseLoan, didn’t recheck for switchEscrow, rollLoan, etc.

- r

msg.sender == escrow.loans,!escrow.released _releaseCalculations— withdrawable = owedCappedByAvailable (to escrow by the system); toLoans = change left (all funds - escrowPart)- ^ESNft---lateFee

_interestFeeRefund(escrow)— interestHeldByEscrow x timeLeftUntilEnd%, max 95%uint elapsed = block.timestamp + duration - escrow.expiration; Math.min(elapsed, duration);— time passed after creation; capped by duration- extended

- A: block.timestamp + duration — now + duration

- B: escrow.expiration — creation time + duration

- A - B = now - creation time = time from creation

- duration = escrow.duration = offer.duration — escrow creation time (openLoan) + offer.duration

- set on ^ESNft-createOffer

- used on

escrows[id].expiration = block.timestamp + offer.duration

- extended

uint refund = escrow.interestHeld * (duration - elapsed) / duration;— interestHeld x timeLeftUntilEnd%- escrow.interestHeld — ^ESNft---startEscrow—interestHeld

- (duration - elapsed) — time left

- / duration — convert time left to ration, float number, like %

uint maxRefund = escrow.interestHeld * MAX_FEE_REFUND_BIPS / BIPS_BASE;— 95% of interestHeld

uint targetWithdrawal = escrow.escrowed + escrow.interestHeld + lateFee - interestRefund;— owed to escrow by the system: escrow.escrowed + escrow.interestHeld when borrower created the escrow. lateFee for late payment. And- interestRefundfor early payment ^ESNft---releaseCalculations—targetWithdrawal- — original escrow + fees

- // everything owed: original escrow + (interest held - interest refund) + late fee

- escrow.escrowed — ^ESNft---startEscrow—escrowed — underlyingAmount

- ^ESNft---startEscrow—interestHeld

uint available = escrow.escrowed + escrow.interestHeld + fromLoans;— available in the system: escrow.escrowed + escrow.interestHeld is held on ESNft.fromLoansis available from swap of takeLockedEqMaxLoss ^ESNft---releaseCalculations—available- escrowed and interestHeld hold somewhere? Or just numbers? — held on EscrowSupplierNft.

- startEscrow

- escrowed must be on offer, pulled from offer creator

- fee held on EscrowSNft, pulled from LNft, pulled from borrower

- startEscrow

- (original escrow + interest held) + collarValueOnSettle

- underlyingAmount + originalFee + fromLoans (below)

- does originalUnderlying include takerLocked? — yes, see ^LNft---openLoan—underlyingAmount

- fromLoans — on

forecloseLoan(ignoring other paths) ^LNft---releaseEscrow—toEscrow

- escrowed and interestHeld hold somewhere? Or just numbers? — held on EscrowSupplierNft.

- withdrawal = Math.min(available, targetWithdrawal); — owed by the systme for escrow capped by available in the system

- toLoans = available - withdrawal; — collar position profit after fees ^ESNft---releaseCalculations—toLoans

- — if owed to escrow < available in the system (for this collar position) return the change ( collar position minus all the fees is in profit); if escrow part is less than available send the rest to LNft; Meaning that collar made a profit even after escrow fees + lateFees

- ^ESNft---releaseCalculations—targetWithdrawal

- ^ESNft---releaseCalculations—available

- update released = true, withdrawable = owedCappedByAvailable

- returns: toLoans — ^ESNft---releaseCalculations—toLoans

- pull

repaidfrom LoansNft, return change to LoansNft — seems that it is collarValue; but they expect all funds, .escrowed + fees; see ^n3- change = toLoans = ^ESNft---releaseCalculations—toLoans

repaid= ^LNft---releaseEscrow—toEscrow

- returns: toLoans — ^ESNft---releaseCalculations—toLoans

- return: underlyingOut = fromEscrow + leftOver; — Collar profit (price grows/stays) + leftOver (in case of U big price drop)

- fromEscrow — see ^ESNft---releaseCalculations—toLoans

- leftOver = fromSwap - toEscrow; — in case underlying dropped many times escrow stored underlying worth less

- ^LNft---releaseEscrow—fromSwap

- ^LNft---releaseEscrow—toEscrow

- when can we owe less than

fromSwap? — maybe if collateral drop to ~0, so all escrowed worth nothing. SofromSwapis a lot

underlying.safeTransfer(borrower, toBorrower)- Funds movement

- On

openEscrowLoan- funds already on ESNft contract, after ^ESNft-createOffer

- new funds are moved from borrower to LoansNft contract, sold and given to the borrower

- part of the funds is kept on TakerNft contract, maxLoss

- On

- Summary

-

closeLoan — settle, move funds to contracts, but some funds to borrower

_settleAndWithdrawTaker— settle taker and provider, move taker’s (tackerLocked + profit) to caller (LoansNft.sol)takerNFT.expirationAndSettled(takerId)— read- get expiration from providerNft

- read settled from takerNFT storage

takerNFT.settlePairedPosition(takerId)— for provider and taker, depending on P&Ls: move funds, update storage for their NFTs (settled=true and withdrawable), depending on P&Ls ^CTakerNft-settlePairedPosition- Summary

- get P&Ls for taker, provider

- move funds between taker and provider

- set settle takerNft, providerNft

- write withdrawable for both

- getPosition(takerId) —

Transclude of #ctakernft-getposition

- require exist, !expired, !settled

_settlementCalculations— amounts P&Ls, capped by put/call strikes ^CTNft---settlementCalculations- uint startPrice = position.startPrice;

- set in ^CTakerNFT-openPairedPosition from oracle price of U at that time

_strikePrices(position.putStrikePercent, position.callStrikePercent, startPrice)— convert percents to price (x startPrice)- putStrikePercent, callStrikePercent set in ^CProviderNFT-createOffer, chose by provider(msg.sender)

- Math.max(Math.min(endPrice, callStrikePrice), putStrikePrice) — capped price

[put; endPrice; call]- endPriceCappedAbove: Math.min(endPrice, callStrikePrice)

- when endPrice < callStrikePrice, call is OTM

- when call OTM use current price

- when call ITM use call price

- so limit the price by call price

- Math.max(endPriceCappedAbove, putStrikePrice)

- when endPriceCappedAbove > putStrikePrice use it

- but if endPrice below putStrikePrice use put strike

- so capped below by put strike

- endPriceCappedAbove: Math.min(endPrice, callStrikePrice)

- takerBalance = position.takerLocked; — ^CTakerNFT-openPairedPosition—takerLocked

if (endPrice < startPrice) {— has some loss from takerBalance=maxLoss, move asset from taker to provideruint providerGainRange = startPrice - endPrice;— loss real, capped by putuint putRange = startPrice - putStrikePrice;— maxLoss (below is covered by put)uint providerGain = position.takerLocked * providerGainRange / putRange;— maxLoss x (realLoss / maxLoss) = realLoss- takerBalance -= providerGain; providerDelta = providerGain.toInt256(); — take from taker, add to provider

- why add to provider? — to keep provider’s payout constant between strikes

- provider has U. to keep the middle part straight on U price drop we need to pay them so (U + payment) stays constant; and on grow we need to take from them

- I guess that put writer will keep putStrike on them, so putWriterCashUsed + takerCashUsed + U price always constant. When below start Price. When above then surplus will be first given to taker, then to putWriterCallBuyer = collarWriter

- For provider pay off diagram is unlimited on both sides (profit on up, loss on down) and flat between strikes

- U price dropped

- borrower’s(B) put range (putStrike - start)

- B has the right to sell their U for putStrike

- if they return cash, want back U, they will get it

- but to buy it back they need less cash, so from maxLoss = takerBalance some will be left

- provider held U

- provider got loss on U if counted in cash

- …

- Example

- U was 1000, putStrike 900, callStrike 1100

- price wall to 950

- borrower

- gets back 1U, spend 900+50

- 50 left

- bought a put, have the right to sell for 900, OTM

- wrote a call, have the obligation to sell for 1100, OTM

- provider

- wrote the put, have an obligation to buy by 900

- but the price is above, so OTM, don’t have to buy

- bought a call, have the right to buy for 1100

- OTM

- wrote the put, have an obligation to buy by 900

- why add to provider? — to keep provider’s payout constant between strikes

- else — move assets from provider to taker

- takerGainRange = endPrice - startPrice; — profit capped by callStrike

- callRange = callStrikePrice - startPrice; — max profit for taker

- position.providerLocked * takerGainRange / callRange — locked x % of max profit

- uint startPrice = position.startPrice;

- set .settled and allow taker to get their locked + profit

- (putStike … spot … callStrike) ⇒ (0 … takerLocked … takerLocked x 2)

providerNFT.settlePosition(providerId, providerDelta);— ^CProviderNFT-settlePosition

- Summary

takerNFT.withdrawFromSettled(takerId)— move takerId funds to LoanNft (msg.sender)- only NFT owner, !settled

- burn NFT, transfer all withdrawable to caller(LoanNft in code)

- returns: withdrawable (transfered)

- see also ^LNft-forecloseLoan—cashAvailable, explains withdrawFromSettled

- uint repayment = loan.loanAmount; — loaned to taker

- set in?

- ^LNft-rollLoan

- ^LNft---openLoan

- From ^LNFT---swapAndMintCollar , sent to borrower

- set in?

- pull from borrower loaned funds

- uint cashAmount = repayment + takerWithdrawal; — borrowed + lockedLeft + profit

- swap to U

_conditionalReleaseEscrow(loan, underlyingFromSwap)— pay escrow debt + fees from LoansNft.sol, mark released, returns cahnge from swap (goes to borrower)_releaseEscrow(loan.escrowNFT, loan.escrowId, fromSwap)— ^LNft---releaseEscrow

- pay the leftOvers to borrower

- ^sh

-

rollLoan — create new Loan with new T&P pair ^LNft-rollLoan

- onlyNFTOwner(loanId) — no keeper

canOpenPair(underlying, cashAsset, address(this)— whitelist- r

block.timestamp <= _expiration(loanId)_expiration—Transclude of #lnft---expiration

_burn(loanId)— burn the LNftLNft._executeRoll(loanId, rollOffer, minToUser)— cancel last Pair, mint new, rearange cash ^LNft---executeRollconfigHub.canOpenPair(underlying, cashAsset, address(rolls)— rollOffer.rolls (user-provided) WL- uint initialBalance = cashAsset.balanceOf(address(this));

- rolls.previewRoll — calc: settles, scale locked to new U price, deltas for P&T, fees

- getRollOffer(rollId) — simple read

- offer.feeReferencePrice

- set on ^Rolls-createOffer from takerNFT.currentOraclePrice()

- calculateRollFee — base modified depending on price change ^Rolls-calculateRollFee

- price — current oracle price

SignedMath.abs(offer.feeAmount).toInt256()— remove sign- offer.feeAmount

- set on ^Rolls-createOffer, user-provided, not checked

-

The base fee for the roll, can be positive (paid by taker) or negative (paid by provider)

- offer.feeAmount

int change = feeSize * offer.feeDeltaFactorBIPS * priceChange / prevPrice / int(BIPS_BASE);— feeAmtAbs x (fdf x priceChange%)- offer.feeDeltaFactorBIPS, set on ^Rolls-createOffer, < 100_00 (bips_base)

-

How much the fee changes with price, in basis points, can be negative. Positive means asset price increase benefits provider, and negative benefits user.

-

- priceChange — now - start

- — fee x fdf x priceDiff / prevPrice = fee x fdf x priceChange%

- comment — feeAmtAbs x (fdf x priceChange%)

- // Scaling the fee magnitude by the delta (price change) multiplied by the factor.

- // For deltaFactor of 100%, this results in linear scaling of the fee with price.

- // So for BIPS_BASE the result moves with the price. E.g., 5% price increase, 5% fee increase.

- // If factor is, e.g., 50% the fee increases only 2.5% for a 5% price increase.

- offer.feeDeltaFactorBIPS, set on ^Rolls-createOffer, < 100_00 (bips_base)

- rollFee = offer.feeAmount + change;

- offer.feeAmount — in assets, base that will be used

- comment

- // Apply the change depending on the sign of the delta * price-change.

- // Positive factor means provider gets more money with higher price.

- // Negative factor means user gets more money with higher price.

- // E.g., if the fee is -5, the sign of the factor specifies whether provider gains (+5% → -4.75)

- // or user gains (+5% → -5.25) with price increase.

Transclude of #ctakernft-getposition

_previewRoll— calc: settles, scale locked to new U price, deltas for P&T, fees ^Rolls---previewRoll- (uint takerSettled, int providerGain) = takerNFT.previewSettlement(takerPos, newPrice) — just calls ^CTNft---settlementCalculations

(uint newTakerLocked, uint newProviderLocked) = _newLockedAmounts(takerPos, newPrice)— scale maxLoss, maxProfit (both for taker) to the new U price ^Rolls---newLockedAmounts- comment

- // New position is determined by calculating newTakerLocked, since it is the input argument.

- // Scale up using price to maintain same level of exposure to underlying asset.

- // The reason this needs to be scaled with price, is that this can should fit the loans use-case

- // where the position should track the value of the initial amount of underlying asset

- // (price exposure), instead of (for example) initial cash amount.

- // Note that this relationship is not really guaranteed, because initial underlying

- // to cash conversion was at an unknown swap-price.

- newTakerLocked = takerPos.takerLocked * newPrice / takerPos.startPrice; — scale takerLocked to newPrice, 1:1

- takerPos.takerLocked — ^CTakerNFT-openPairedPosition—takerLocked

newPrice / takerPos.startPrice— price as % of oldPrice

- takerNFT.calculateProviderLocked( — recalculate max profit

- comment

- protocolFee — ^CProviderNft-protocolFee

- int toTaker = takerSettled.toInt256() - newTakerLocked.toInt256() - rollFee; — delta to pull from/send to taker; == last position results - new locked (maxLoss) - rollFee

- takerSettled — amt delta for taker

- newTakerLocked — maxLoss scaled to new U price

- int toProvider = providerSettled - newProviderLocked.toInt256() + rollFee - protocolFee.toInt256(); — delta balance for provider; last collar result - maxProfitForTaker + rollFee;

- pull delta funds from taker, approve rolls for the funds and loanIdNft

- rolls.executeRoll — cancel last Paired, mint new Paired, rearange cash (m.c for Taker) ^Rolls-executeRoll

- getRollOffer — just load from storage

- validations

- .active

- set to true on ^Rolls-createOffer

- set to false on ^Rolls-cancelOffer and ^Rolls-executeRoll (here)

msg.sender == takerNFT.ownerOf(offer.takerId)— r called by LoanNft (in code) ^Rolls—owner-of-new-offer- offer can be created only from old provider

Rolls._executeRoll— safeTransferFrom(provider, roll offer.provider, msg.sender == takerNFT.ownerOf(offer.takerId), but- Rolls.createOffer provider: msg.sender,

- It means provider created, and taker accepted

- And when createOffer check that it’s called from old provider ⇒ old provider == newProvider, see ^n4—old-new-provider-on-createOffer

- Rolls.createOffer provider: msg.sender,

block.timestamp <= takerPos.expiration— not expired- set on ^CProviderNFT-mintFromOffer to block.timestamp + offer.duration, between min and max (set by admins)

- offer.duration set on ^CProviderNFT-createOffer, up to uint32

- set on ^CProviderNFT-mintFromOffer to block.timestamp + offer.duration, between min and max (set by admins)

- U oracle price between rollOffer.maxPrice, minPrice

- set on ^Rolls-createOffer, only checks min ⇐ max

- rollOffer.deadline

- .active

rollOffers[rollId].active = false- ^Rolls-calculateRollFee

- ^Rolls---previewRoll

- r

toTaker >= minToTaker- minToTaker — passed from top ^LNft-rollLoan by the caller

_executeRollminToUser- rollLoan minToUser

- minToTaker will be used for verification later in ^LNft---executeRoll

- minToTaker — passed from top ^LNft-rollLoan by the caller

- toProvider >= offer.minToProvider

- offer.minToProvider — set on ^Rolls-createOffer, not checked

Rolls._executeRoll— cancel original Paired nfts (possibly old), mint new, rearange cash between P&m.c. for Taker ^Rolls---executeRoll- Summary

- pull takerNft from m.s (~LoansNft)

- cancel both (see also ^n4)

- open new paired P&T Nfts

- transfer TakerNft to m.s (~LNft.sol)

- transfer ProviderNft to offer.provider (original creator or a new offer)

- update-transfer cash

- provider’s to provider

- taker’s to m.s (~LoansNft)

- takerNFT.transferFrom(msg.sender, address(this), offer.takerId); — pull from ~LoansNft.sol

- msg.sender — LoansNft by default, ownership of offer.takerId checked in ^Rolls-executeRoll

_cancelPairedPositionAndWithdraw— both P&T: .settled(true), burn NFTs, transfer funds to Rolls (here)- takerPos.providerNFT.approve(address(takerNFT), takerPos.providerId);

- why can we approve from rolls? — pulled in ^Rolls-createOffer

- how do we know that it’s correct providerId? How is it validated on takerPosition? — seems to be unique and minted on ^CTakerNFT-openPairedPosition

- CTakerNft.cancelPairedPosition — both P&T: .settled=true, burn NFTs, transfer funds to caller ^CTakerNft-cancelPairedPosition

- ^CTakerNft-getPosition

- validations

- msg.sender == ownerOf(takerId) — Rolls.sol (caller) owns the NFT

- msg.sender — in code Rolls. Pulled from LNft.sol on ^Rolls---executeRoll

- msg.sender == providerNFT.ownerOf(providerId) — Rolls.sol owns the NFT

- !settled

- false on ^CTakerNFT-openPairedPosition

- true on ^CTakerNft-settlePairedPosition

- true on here (^CTakerNft-cancelPairedPosition)

- msg.sender == ownerOf(takerId) — Rolls.sol (caller) owns the NFT

positions[takerId].settled = true;burn(takerId)- ^CProviderNFT-cancelAndWithdraw

- transfer both takerLocked, providerLocked to msg.sender (Rolls)

- How come we have takerLocked? — it is CTakerNft, so on ^CTakerNFT-openPairedPosition

- uint expectedAmount = takerPos.takerLocked + takerPos.providerLocked; — cached value == real values

- takerPos.providerNFT.approve(address(takerNFT), takerPos.providerId);

- pull from ~LNft

-toTaker, from provider (-toProvider)- if diff is negative we need to pull, otherwise push

_openNewPairedPosition— create ProviderOffer; create pairedPosition (P&T nfts, owner=Rolls)- uint offerAmount = preview.newProviderLocked + preview.protocolFee; — new maxLoss + new protocolFee

- preview.newProviderLocked — maxLoss scaled to new U price

- — calculated in ^LNft---executeRoll → ^Rolls---previewRoll → ^Rolls---newLockedAmounts

- preview.protocolFee — same as above, see ^CProviderNft-protocolFee

- preview.newProviderLocked — maxLoss scaled to new U price

cashAsset.forceApprove(address(providerNFT), offerAmount);- ^CProviderNFT-createOffer

- cashAsset.forceApprove(address(takerNFT), preview.newTakerLocked);

- ^CTakerNFT-openPairedPosition

- does it use old providerNft or newly minted? — new, in theory, we provide a newly created providerOffer ⇒ PairedPosition (P&T nfts) ⇒ RollOffer

- back through callstack, up to

openPairedPosition- Call stack top to bottom ^rollLoan-call-waterfall

- provider1 calls ^CProviderNFT-createOffer

- get LiquidityOffer.offerId

- .provider set to msg.sender (provider1)

- pulled cash from msg.sender

- get LiquidityOffer.offerId

- ms2 calls ^CTakerNFT-openPairedPosition

- provide LiquidityOffer.offerId

- get takerId (minted to msg.sender (ms2), takerId2),

- get paired providerId (minted to offer.provider (provider1))

- Note: 2 above are not required, it seems that we use old takerId

- provider1 calls ^Rolls-createOffer

- provide takerId

- providerNft1 pulled from provider1 to Rolls

- rollOffer

- .provider = msg.sender = provider1

- .providerId = providerNft1

- .takerId = takerId2

- returns rollId3

- loanOwner=borrower=loanOwner4 calls ^LNft-rollLoan

- provides loanId4 (owned by loanOwner4)

- rollOffer.id = rollId3 (provider1, providerNft1, takerId2)

- in →

Rolls._executeRollproviderNft1 and paired takerId2 will be cancelled, new ones will be opened from Rolls: providerNft5 and takerNft5

- provider1 calls ^CProviderNFT-createOffer

- Note: maybe not finished

- — →

_executeRoll(preview)→_openNewPairedPosition(preview)→ openPairedPosition(preview.takerPos.providerNFT) - ← in

_openNewPairedPositionread from preview.takerPos.providerNFT - ←

previewpassed toRolls._executeRoll - ←

previewset inRolls.executeRoll- from

_previewRoll(takerPos) takerPos = takerNFT.getPosition(offer.takerId)steps top to bottom- offer.takerId from getRollOffer(rollId)

- rollId from

rollOfferinLNft._executeRoll - passed by caller

- RollOffer.id set it Rolls.createOffer

- takerId passed by user

- can be created on openPairedPosition

- from

- Call stack top to bottom ^rollLoan-call-waterfall

- back through callstack, up to

- does it use old providerNft or newly minted? — new, in theory, we provide a newly created providerOffer ⇒ PairedPosition (P&T nfts) ⇒ RollOffer

- uint offerAmount = preview.newProviderLocked + preview.protocolFee; — new maxLoss + new protocolFee

- push cash toTaker, toProvider

- transfer TakerNft to m.s (~LoansNft)

- Qs

- offer.takerId vs preview.takerPos in

Rolls._executeRoll— same- offer.takerId

- from

rollIdpassed by user

- from

- takerPos — same, read like takerNFT.getPosition(offer.takerId)

- preview.takerPos — unchanged takerPos

- preview.takerPos.providerId — paired to offer.takerId

- offer.takerId

- offer.takerId vs preview.takerPos in

- Summary

- push toTaker cash to taker

- verify balance not changed

- getLoan(loanId) — just load from storage

_loanAmountAfterRoll— just +- toUser, no new calculations- params

- fromRollsToUser = toUser = toTaker — diff to send to taker after roll

- rollFee — from ^Rolls-calculateRollFee

- prevLoan.loanAmount — in cash

- int loanChange = fromRollsToUser + rollFee;

- if we calculated that the user get funds loan amount change down. Otherwise up

- params

_newLoanIdCheck— checkloans[takerId].underlyingAmount== 0_conditionalSwitchEscrow— end, start, transfer fees- params

- newFee — user provided

configHub.canOpenSingle(underlying, address(escrowNFT)— WL- pull newFee from borrower=taker=m.s

- escrowNFT.switchEscrow — end + start, handle fee transfers with m.s (~LNft)

- !expired

- comment above

_endEscrow— about funds internal accounting-

initially user’s escrow “E” secures old ID, “O”. O’s supplier’s funds are away.

-

E is then “transferred” to secure new ID, “N”. N’s supplier’s funds are taken, to release O.

-

O is released (with N’s funds). N’s funds are now secured by E (user’s escrow).

-

Interest is accounted separately by transferring the full N’s interest fee

-

(held until release), and refunding O’s interest held.

-

// “O” (old escrow): Release funds to the supplier.

-

// The withdrawable for O’s supplier comes from the N’s offer, not from Loans repayment.

-

// The escrowed loans-funds (E) move into the new escrow of the new supplier.

-

// fromLoans must be 0, otherwise escrow will be sent to Loans instead of only the fee refund.

-

- ^ESNft---endEscrow

- ^ESNft---startEscrow

- pull/push fee updates from/to caller (~LNft)

_escrowValidations— loanId and expiration- transfer feeRefund to borrower=taker=m.s

- params

- write to storage, mint LNft

-

unwrapAndCancelLoan ^LNft-unwrapAndCancelLoan

-

_endEscrow^LNft---endEscrow- See ^ESNft---endEscrow

- Called by

- ESNft.endEscrow

- ESNft.switchEscrow

-

-

EscrowSupplierNFT

- startEscrow — Starts a new escrow using funds from an existing offer or part of it ^ESNft-startEscrow

- Only by

loansCanOpen[msg.sender], checked in ^ESNft---startEscrow - takerNFT — immutable, set in constructor

- escrowed — on open borrower-provided underlyingAmount

- everything else is user provided

escrowId = _startEscrow(offerId, escrowed, fee, loanId);— Removeescrowedamount fromoffers[offerId].available, createescrows[escrowId], add toescrows[escrowId]^ESNft---startEscrow- escrowed — set only on ^ESNft---startEscrow, never changed. After

_openLoanwill be borrower-provided underlyingAmount ^ESNft---startEscrow—escrowed - called by: startEscrow and switchEscrow

require(loansCanOpen[msg.sender], "escrow: unauthorized loans contract");— whitelisted msg.senderrequire(configHub.canOpenSingle(asset, address(this)), "escrow: unsupported escrow");— check again that can open, last checked in ^LNft---conditionalOpenEscrow—canOpenSingle- asset — set in constructor of EscrowSupplierNFT; checked to be

underlyingin ^LNft---conditionalOpenEscrow above

- asset — set in constructor of EscrowSupplierNFT; checked to be

Offer memory offer = getOffer(offerId);— load from storage- How is it set in storage? — ^ESNft-createOffer and ^ESNft-updateOfferAmount

require(offer.supplier != address(0), "escrow: invalid offer"); // revert here for clarity— make sure offer is setrequire(configHub.isValidCollarDuration(offer.duration), "escrow: unsupported duration");—min <= duration <= maxrequire(fee >= interestFee(offerId, escrowed), "escrow: insufficient fee");— onstartEscrowset by user; can provide bigger fee than ceil(required), but not less ^ESNft---startEscrow—fee- on

startEscrowset by user - ceil( escrowed x APR x duration / (bips x seconds per year) )

- on

require(escrowed >= offer.minEscrow,uint prevOfferAmount = offer.available; require(escrowed <= prevOfferAmount,— ⇐ than deposited- offer.available — amount on ESNft. set on

createOffer, and updated onupdateOfferAmount. Transfers that amount to/from msg.sender.

- offer.available — amount on ESNft. set on

offers[offerId].available -= escrowed;escrowId = nextTokenId++;escrows[escrowId] = EscrowStored({ ... });escrowId— EscrowSupplierNFT.tokenIdEscrowStored({ ... })offerId— user providedloanId—takerNFT.nextPositionId()in ^LNft---conditionalOpenEscrowexpiration:released: false^EscrowSupplierNFT-escrows—released- Updated in

- ESNft.lastResortSeizeEscrow — = true

- ^LNft---endEscrow — = true

- Used in

- withdrawReleased — require(released)

- lastResortSeizeEscrow — !released

- ^LNft---endEscrow — !released

- Updated in

loans: msg.sender— LoanNft by default; checked on ^LNft---endEscrow, only loans can end- msg.sender is LNft by default

- msg.sender is checked to be

loansCanOpen

escrowed: escrowedinterestHeld: fee^ESNft---startEscrow—interestHeld- = fee that is >= escrowed x duration x APR on

_startEscrow- set to fee on ^ESNft---startEscrow, see also ^ESNft---startEscrow—fee

- Used in

lastResortSeizeEscrow— returned to the ownerOf(escrowId)- set in

_startEscrow(here) - part of targetWithdrawal and available in

_releaseCalculations← ^LNft---endEscrow/previewRelease_interestFeeRefundreduces it on time elapsed, so refund is the bigger the earlier you withdraw — returned toloanNftcontracttoLoansreturned to msg.sender onendEscrow.msg.sendermust beloans.loansis LoanNft by defualt

- GPT — The Purpose and Utilization of `interestHeld`

- = fee that is >= escrowed x duration x APR on

withdrawable: 0- Set to 0 on

withdrawReleased - Set to nonZero on ^LNft---endEscrow

- Used in

withdrawReleased— set to 0, sent to msg.sender == ownerOf(escrowId)- on ^LNft---endEscrow from

_releaseCalculations— basically something like depositedButNotLent or balanceOf. not 100% understand btwwithdrawal = Math.min(available, targetWithdrawal);uint targetWithdrawal = escrow.escrowed + escrow.interestHeld + lateFee - interestRefund;— deposited and not lent + fee from deposit + lateFee - refundForBorroweruint available = escrow.escrowed + escrow.interestHeld + fromLoans;— deposited and not lent + fee from deposit + ~repaid

- GPT — `withdrawable` in `EscrowStored`

- Set to 0 on

_mint(offer.supplier, escrowId);— simple mint, check that is not minted before (revert)- offer.supplier — set on ^ESNft-createOffer to msg.sender (some supplier, who provided asset for the offer)

- escrowed — set only on ^ESNft---startEscrow, never changed. After

asset.safeTransferFrom(msg.sender, address(this), escrowed + fee); asset.safeTransfer(msg.sender, escrowed);— pull fee from msg.sender (LoanNFT usually), 2 transfers for tax reasons, see GPT’s CGT Tax Implications in `startEscrow`]

- Only by

- createOffer ^ESNft-createOffer

- updateOfferAmount ^ESNft-updateOfferAmount

- switchEscrow ^ESNft-switchEscrow

- startEscrow — Starts a new escrow using funds from an existing offer or part of it ^ESNft-startEscrow

-

CollarProviderNFT

- settlePosition — pull/push delta from/to taker; set withdrawable; set settled=true ^CProviderNFT-settlePosition

- Comment explained by GPT: Why Automatic Withdrawals to Providers are Undesirable in the `settlePosition` Function

- onlyTaker

- exist, !expired, !setttled

- set settled

- initial = position.providerLocked — ^CTakerNFT-openPairedPosition—providerLocked

- set on ^CProviderNFT-mintFromOffer

- passed from ^CTakerNFT-openPairedPosition

- calculated in ^CTakerNFT-openPairedPosition—providerLocked

if (cashDelta > 0) {— U down, profit for the provider, loss for the taker; pull funds from taker on CProviderNft contract; allow provider to withdraw initial + fromTaker- when does provider get profit?

- when price of U drops

- in ^CTNft---settlementCalculations, but it’s capped by maxLoss of taker

- position.withdrawable = initial + toAdd;

- initial = position.providerLocked

- no need to pay anything, but get up to maxLoss from taker

- pull funds from taker

- when does provider get profit?

- else { — U up; loss for provider, profit for taker; just send to taker, allow provider to withdraw less

- capped by maxProviderLoss

- What about edge cases? — seems to allow initial (100%), so should be fine

- capped by maxProviderLoss

- Called by ^CTakerNft-settlePairedPosition

- cancelAndWithdraw — .settled = true, burn nft, transfer all funds to caller ^CProviderNFT-cancelAndWithdraw

- validations

- .expiration != 0 — set

- !settled

- false on ^CProviderNFT-mintFromOffer

- true on ^CProviderNFT-settlePosition

- true on ^CProviderNFT-cancelAndWithdraw (here)

bool callerApprovedForId = _isAuthorized(ownerOf(positionId), msg.sender, positionId);— isOwner || isOperator || isApproved

- providerPosition.settled = true

_burn(positionId)- transfer all locked to msg.sender (CTakerNft in code), but no update

- validations

- mintFromOffer — write position data to storage and mint NFT ^CProviderNFT-mintFromOffer

onlyTaker— ~CTakerNFT- who is taker here? — immutable, set on creation; probably only CTakerNFT

- Called only from in code ^CTakerNFT-openPairedPosition

configHub.canOpenPair(underlying, cashAsset, msg.sender,configHub.canOpenPair(underlying, cashAsset, address(this)— taker and provider whitelistedconfigHub.isValidLTV(ltv)— min ⇐ ltv ⇐ maxconfigHub.isValidCollarDuration(offer.duration)— min ⇐ duration ⇐ max(uint fee, address feeRecipient) = protocolFee(providerLocked, offer.duration);— up to 1% per year, depends on offer.duration ^CProviderNft-protocolFee- configHub.feeRecipient() == address(0) ? 0

Math.ceilDiv(providerLocked * configHub.protocolFeeAPR() * duration, BIPS_BASE * YEAR)— fee in cash amount, depends on offer.durationproviderLocked * configHub.protocolFeeAPR() * duration— fee for the duration of the positionproviderLocked— funds locked on the provider, max profit for takerconfigHub.protocolFeeAPR()— fee per year, up to 1%; in bips- GPT: The `protocolFeeAPR`

duration— LiquidityOffer.duration, seconds, set on LiquidityOffer creation

BIPS_BASE * YEAR- /BIPS_BASE — “convert” protocolFeeAPR to normal “float”

- /YEAR — convert protocolFeeAPR to per second

providerLocked >= offer.minLocked— because amt is from taker, make sure taker order is not too small- providerLocked — amt x (callStrike - spot), ^CTakerNFT-openPairedPosition—providerLocked

- offer.minLocked — LiquidityOffer, set by provider

uint prevOfferAmount = offer.available; providerLocked + fee <= prevOfferAmount— to lock + fee ⇐ availableuint newAvailable = prevOfferAmount - providerLocked - fee; liquidityOffers[offerId].available = newAvailable;— remove locked and fee from unfilled orderpositionId = nextTokenId++; positions[positionId] = ProviderPositionStored({— just write everything to storage_mint(offer.provider, positionId);— mint the NFT representingProviderPositionStoredaboveif (fee != 0) cashAsset.safeTransfer(feeRecipient, fee);— send fee

- createOffer — validate, write storage, pull amount from

msg.sender^CProviderNFT-createOffer- 100_01 ⇐ callStrikePercent ⇐ 1000_00 — 100,01% - 1000%

- See usage of callStrikePercent here ^CTakerNFT-openPairedPosition—providerLocked

- putStrikePercent ⇐ 99_99

- duration ⇐ uint32 — ~100years

- 100_01 ⇐ callStrikePercent ⇐ 1000_00 — 100,01% - 1000%

- settlePosition — pull/push delta from/to taker; set withdrawable; set settled=true ^CProviderNFT-settlePosition

-

CollarTakerNFT

- getPosition — read some data from storage, some from providerNft’s storage, validate .providerNft set ^CTakerNft-getPosition

-

ChainlinkOracle

- currentPrice ^ChainlinkOracle-currentPrice

-

CombinedOracle

- currentPrice ^CombinedOracle-currentPrice

-

Rolls ^Rolls

- createOffer ^Rolls-createOffer

- Only from old provider: takerNFT.getPosition(takerId) ⇒ takerPos.providerId ⇒ providerNFT.ownerOf(providerId) == msg.sender

- cancelOffer ^Rolls-cancelOffer

- executeRoll ^Rolls-executeRoll

- createOffer ^Rolls-createOffer

Md chunks (GPT)

The Purpose and Utilization of interestHeld

The interestHeld variable, found within the EscrowStored struct in the EscrowSupplierNFT.sol contract, represents the upfront interest fee paid by the borrower to the escrow supplier at the start of an escrow-backed loan. This fee is calculated based on the offer’s interest rate, duration, and the escrowed amount, and is designed to compensate the supplier for their service and the opportunity cost of locking up their funds.

Here’s how interestHeld is used within the contract:

- Initialization: When a new escrow agreement is initiated via the

startEscrowfunction, the borrower provides the escrowed amount along with the upfront interest fee. This fee is then stored in theinterestHeldvariable of the newly createdEscrowStoredstruct for that specific escrow agreement. - Escrow Termination: Upon loan repayment or when the escrow is released using

endEscrow, the_releaseCalculationsfunction determines the final amount to be returned to the borrower, taking into account potential late fees and refunds. This function considers theinterestHeldamount when calculating the target withdrawal amount for the supplier. - Early Release Refund: If the escrow is released before the full loan duration, a portion of the

interestHeldfee might be refunded to the borrower. The_interestFeeRefundfunction calculates this refund based on the remaining duration of the escrow. - Last Resort Seizure: If the escrow provider invokes the

lastResortSeizeEscrowfunction after the grace period, they receive the full escrowed amount plus theinterestHeldfee as compensation for the borrower’s default.

Key Points Regarding interestHeld:

- It reflects the upfront payment model for interest in escrow-backed loans within this system.

- It contributes to the calculation of the supplier’s total earnings upon escrow termination.

- It may be partially refunded to the borrower if the escrow is released early.

- It represents a source of compensation for the supplier in case of a last-resort seizure.

Important Note: The contract doesn’t directly use the annual percentage rate (APR) when calculating the interest refund during early release. Instead, it uses a simpler proportional calculation based on the elapsed time and the total interestHeld amount to ensure consistency and avoid rounding discrepancies.

withdrawable in EscrowStored

The withdrawable variable, part of the EscrowStored struct in EscrowSupplierNFT.sol, represents the total amount of underlying tokens that the escrow supplier can withdraw once the escrow agreement is concluded and the released flag is set to true. This amount includes the original escrowed amount, the accrued interestHeld fee, any applicable late fees, and potential deductions due to shortfalls or refunds.

Usage of withdrawable

- Initialization: When an escrow agreement is created using the

startEscrowfunction,withdrawableis initially set to 0. It remains at 0 until the escrow is released. - Escrow Termination: When the

endEscrowfunction is called, typically triggered by loan repayment or a last-resort seizure, the_releaseCalculationsfunction determines the finalwithdrawableamount for the supplier. This calculation considers therepaidamount from the borrower, any late fees, and potential interest refunds. - Withdrawal by Supplier: Once

releasedistrue, the escrow supplier can invoke thewithdrawReleasedfunction to withdraw the funds represented bywithdrawable. This function transfers the specified amount of underlying tokens from the escrow contract to the supplier’s address.

Key Points

withdrawableserves as a temporary holding place for the supplier’s earnings until they are withdrawn.- It ensures that the supplier receives the correct payout upon escrow termination, factoring in all relevant fees and adjustments.

- The

withdrawablevalue is 0 until the escrow is released, preventing premature withdrawals by the supplier.

Illustrative Example

Let’s say a borrower starts an escrow-backed loan for 100 ETH with an upfront interest fee of 1 ETH. The escrowed amount would be 100 ETH, and interestHeld would be 1 ETH. Initially, withdrawable would be 0.

If the borrower repays the loan on time and in full, the endEscrow function would be called with a repaid amount of 100 ETH. The _releaseCalculations function would determine that no late fees are due and no interest refund is applicable. As a result, withdrawable would be set to 101 ETH (100 ETH escrowed + 1 ETH interestHeld). The supplier could then withdraw this amount using withdrawReleased.

If the borrower fails to repay the loan, the supplier could choose to invoke lastResortSeizeEscrow after the grace period. In this scenario, withdrawable would be set to the sum of escrowed and interestHeld (101 ETH), and the supplier could withdraw this amount.

Note

The sources do not explicitly mention how withdrawable is affected by partial repayments or shortfalls during loan repayment. This behavior would depend on the specific implementation of the _releaseCalculations function and how it handles such situations.

CGT Tax Implications in startEscrow

The phrase “from CGT tax lows perspective” in the startEscrow function’s comments in **** refers to the careful structuring of asset transfers to potentially achieve favorable treatment under Capital Gains Tax (CGT) regulations. The objective is to ensure that the underlying tokens used for the swap in the LoansNFT.sol contract are considered to be supplied by the escrow provider (“supplier’s” funds) and not the borrower (“borrower’s” funds).

Here’s a breakdown of how the code achieves this:

-

Separate Transfers: The

startEscrowfunction in **** executes two distinct token transfers:- Borrower to Escrow: The borrower’s funds, consisting of the escrowed amount and the upfront interest fee, are transferred from the borrower (

msg.sender) to the escrow contract (address(this)). - Escrow to Loans: The escrow contract then transfers only the escrowed amount to the

LoansNFT.solcontract (msg.sender), effectively mimicking the supplier providing the funds for the loan.

- Borrower to Escrow: The borrower’s funds, consisting of the escrowed amount and the upfront interest fee, are transferred from the borrower (

-

Rationale: This two-step transfer process aims to establish a clear separation between the borrower’s initial deposit and the funds used for the swap in the lending contract. By routing the funds through the escrow contract, the code attempts to portray the transaction as the supplier providing the tokens for the loan, potentially minimizing the borrower’s immediate CGT liability.

-

Tax Implications: The exact tax implications would depend on the specific jurisdiction’s CGT regulations. However, by structuring the transfers in this manner, the code seeks to:

- Defer Capital Gains: Delay the recognition of capital gains until the loan’s maturity or the eventual sale of the underlying asset by the supplier.

- Reduce Taxable Event: Potentially avoid triggering an immediate taxable event upon loan initiation by attributing the asset transfer to the escrow provider.

Important Considerations:

- Jurisdictional Variations: The effectiveness of this strategy would vary significantly based on the specific tax laws of the jurisdiction in question.

- Not Tax Advice: The sources and this explanation do not constitute legal or tax advice. Borrowers and suppliers should consult with qualified tax professionals to fully understand the CGT implications of these transactions.

It’s crucial to remember that tax laws are complex and subject to change. The code’s approach might not guarantee a specific tax outcome, and users should seek professional guidance to ensure compliance with applicable regulations.

What is LoanNFT.underlying?

The LoanNFT.underlying variable refers to the underlying asset used in a specific asset pair of the Collar protocol.

- The

LoansNFT.solcontract manages opening, closing, and rolling of loans through Collar positions with optional escrow support. - The underlying and cash assets are determined by the

CollarTakerNFTcontract associated with theLoansNFTcontract. - The

underlyingvariable inLoansNFTis an instance ofIERC20, representing the ERC-20 token used as collateral for loans in a specific asset pair.

For example, in the deployment script combined-script.sol.txt, LoanNFT.underlying is set to WETH for the WETH/USDC pair. This means WETH is the collateral asset, and users would supply WETH to borrow USDC.

The LoanNFT.sol contract also handles the swapping of the underlying asset to the cash asset through allowed swappers. When a loan is opened, the underlying asset is swapped for the cash asset. When the loan is closed, the cash asset is swapped back to the underlying asset.

The LoansNFT contract uses a ConfigHub contract to determine which asset pairs are supported for opening loans. This allows the protocol to be flexible and support different asset pairs.

The Cash Asset Used in LoanNFT

The LoanNFT.cashAsset variable refers to the ERC-20 token used as the borrowed asset in a particular asset pair within the Collar Protocol. Let’s break this down.

- The

LoansNFT.solcontract is responsible for managing the lifecycle of loans, encompassing the processes of opening, closing, and rolling of loans facilitated through Collar positions, potentially integrated with escrow services. - The specific underlying and cash assets used in a loan are determined by the associated

CollarTakerNFTcontract. - The

cashAssetvariable inLoansNFTis declared as an immutable instance of theIERC20interface. This signifies that once theLoansNFTcontract is deployed, thecashAssetcannot be changed.

How it Works

- Loan Initiation: When a user wants to borrow, they initiate a loan by providing the underlying asset as collateral. The

LoansNFTcontract, using a designated swapper contract, then swaps this underlying asset for the corresponding cash asset. - Loan Disbursement: The borrowed amount, now in the form of the cash asset, is transferred to the borrower.

- Loan Closure: When the borrower is ready to repay the loan, they return the borrowed amount in the form of the cash asset. This cash asset is then swapped back to the underlying asset, which is then returned to the borrower.

Deployment Example

In the deployment script combined-script.sol.txt, the LoanNFT.cashAsset is configured to be USDC for the WETH/USDC asset pair. This implies that users would supply WETH (the underlying asset) as collateral to borrow USDC (the cash asset).

Flexibility and Protocol Governance

The LoansNFT contract leverages a ConfigHub contract to govern which specific asset pairs are supported for loan origination. This architecture provides flexibility in accommodating various asset pairs and adapts to changing market conditions and risk management needs.

It is important to note that the relationship between the underlying and cash assets is crucial in determining the direction of swaps during loan origination and closure. The sources don’t explicitly state this, but based on common DeFi practices, it is likely that the LoansNFT contract is designed to work with asset pairs where the cash asset is considered more stable than the underlying asset. This is a reasonable assumption as it aligns with the goal of mitigating the risk of collateral devaluation for lenders. This is an inference based on common DeFi practices, and you may want to verify it independently.

Understanding the Roles of cashAsset and underlying

The terms cashAsset and underlying represent the two key components of an asset pair within the context of the Collar protocol, specifically within the LoanNFT contract.

cashAsset: This is the borrowed asset, represented as anIERC20token. When a user takes out a loan, they receive this asset. During loan repayment, this is the asset the borrower repays.underlying: This is the collateral asset, also represented as anIERC20token. Users provide this asset to secure their loans. It is swapped forcashAssetat the beginning of the loan and swapped back when the loan is closed.

The specific cashAsset and underlying for a given loan are determined by the CollarTakerNFT contract associated with the loan.

For instance, the combined-script.sol.txt source demonstrates the deployment of a WETH/USDC pair, where:

WETHis theunderlyingasset, acting as collateral.USDCis thecashAsset, the asset borrowed by users.

Relationship and Risk Mitigation

While the sources don’t explicitly state this, it’s likely, based on common DeFi practices, that the cashAsset is typically a more stable asset compared to the underlying asset. This design choice aims to mitigate the risk of collateral devaluation for lenders. For instance, using a stablecoin like USDC as cashAsset reduces the risk associated with volatile assets like ETH, which could be used as underlying. This is an inference, and you may want to verify it.

Interactions in Loan Operations

The LoansNFT contract manages the interaction between these assets throughout the loan lifecycle:

- Loan Opening:

- The borrower provides the

underlyingasset. - The

LoansNFTcontract, using allowed swappers, swaps theunderlyingfor thecashAsset. - The borrower receives the

cashAssetas the loan.

- The borrower provides the

- Loan Closure:

- The borrower repays the loan using the

cashAsset. - The

cashAssetis swapped back to theunderlyingasset. - The borrower receives the

underlyingasset back.

- The borrower repays the loan using the

This structure ensures a consistent flow of assets, facilitating the lending and borrowing operations within the protocol.

A Comparative Analysis of TakerNFT and ProviderNFT Contracts

The sources detail the functionality and interaction of the takerNFT and providerNFT contracts within the Collar protocol. These contracts play distinct roles in facilitating the protocol’s core operations:

takerNFT(CollarTakerNFT.sol):- Manages the taker side of the Collar protocol.

- Handles position settlement, drawing upon oracle prices.

- Interacts with provider NFTs to establish zero-sum paired positions.

providerNFT(CollarProviderNFT.sol):- Enables liquidity providers to create offers.

- Manages provider positions and the associated protocol fees.

- Facilitates provider-side position settlement initiated by the taker NFT and handles provider withdrawals.

Intertwined Roles: Creating and Settling Paired Positions

A closer examination of the source code reveals the specific functions and interactions between these contracts:

-

openPairedPositioninCollarTakerNFT.sol: This function initiates the creation of a paired position. It receives parameters such as the amount to be locked by the taker (takerLocked), the address of the provider NFT contract, and the ID of the offer.- The function checks if both the taker and provider contracts are permitted to open positions for the specified asset pair using the

ConfigHubcontract. - It calculates the amount to be locked by the provider (

providerLocked) based on the taker’s locked amount and the strike prices specified in the offer. - The function ensures the validity of the offer and verifies that strike prices are distinct to avoid edge cases during settlement.

- It calls the

mintFromOfferfunction on the provider NFT contract to mint a provider position, transferring the corresponding provider NFT to the original offer provider. - Finally, it mints a taker NFT to the sender, representing their side of the position, and transfers the taker’s locked funds to the contract.

- The function checks if both the taker and provider contracts are permitted to open positions for the specified asset pair using the

-

mintFromOfferinCollarProviderNFT.sol: This function is called by the taker NFT contract to create a provider position linked to an existing offer.- It ensures that the taker contract is allowed to open positions for the specified asset pair and that the offer parameters are still supported by the protocol configuration.

- The function calculates and deducts the protocol fee based on the provider’s locked amount and the duration of the position, sending the fee to the designated recipient.

- It updates the offer amount to reflect the new available liquidity after deducting the minted position and protocol fee.

- Finally, it mints the provider NFT, representing ownership of the position, to the original offer provider.

-

settlePairedPositioninCollarTakerNFT.sol: This function handles the settlement of a paired position after its expiration.- It utilizes the current oracle price to determine the final payout.

- The function calculates the final balances for both the taker and provider based on the ending price and the strike prices.

- It updates the taker position’s state to reflect settlement and the withdrawable amount.

- The function calls the

settlePositionfunction on the provider NFT contract to transfer funds between the contracts according to the settlement outcome.

-

settlePositioninCollarProviderNFT.sol: This function is invoked by the taker NFT contract during settlement to adjust balances between the contracts.- It ensures the validity of the position ID and verifies that the position has not been previously settled.

- The function calculates the amount of cash to be added to or removed from the provider position based on the settlement outcome (

cashDelta). - It updates the provider position’s state to reflect settlement and the withdrawable amount.

- The function transfers funds between the contracts according to the settlement outcome, requiring approval from the taker contract if the provider is due funds.

Distinct Responsibilities: Minting, Withdrawals, and Cancellations

Beyond the shared responsibility for paired position creation and settlement, the contracts have distinct functions:

takerNFT:- Calculates the

providerLockedamount based on thetakerLockedamount and the strike prices. - Handles cancellation of paired positions (

cancelPairedPosition). - Allows withdrawal of funds from settled positions (

withdrawFromSettled).

- Calculates the

providerNFT:- Allows liquidity providers to create and update offers (

createOffer,updateOfferAmount). - Mints provider position NFTs to the offer provider when an offer is taken.

- Handles cancellation of provider positions (

cancelAndWithdraw). - Manages withdrawals for settled positions by the NFT owner (

withdrawFromSettled).

- Allows liquidity providers to create and update offers (

Additional Insights: Security and Protocol Assumptions

Several key points emerge from the source code that provide further context:

- Trust in Taker Contract: The provider NFT contract trusts the taker NFT contract to manage the taker side of the position and to perform settlement calculations accurately.

- Security Considerations for Settlement: The

settlePositionfunction inCollarProviderNFT.solis designed to avoid triggering a withdrawal to the provider during settlement to mitigate potential risks, including front-running attacks and complications with NFT markets or escrow contracts. - Cancellation Requires Mutual Consent: Cancellation of a paired position necessitates the caller owning both the taker and provider NFTs, ensuring mutual agreement for the cancellation.

The takerNFT and providerNFT contracts operate in a tightly integrated manner to facilitate the creation, settlement, and management of Collar positions. They embody the core mechanics of the protocol, ensuring a consistent and secure environment for both takers and providers to participate in the Collar protocol.

Please note that any inferences made about the stability of cashAsset and underlying are based on common DeFi practices and may not be explicitly stated in the sources. It’s recommended to independently verify these assumptions.

Understanding Loan Creation: A Breakdown of the Code Snippet

This code snippet, found within the _swapAndMintCollar function in combined-src.sol.txt, is crucial for comprehending how loans are generated within the Collar protocol. It centers around the distribution of cash obtained from swapping the user’s collateral (underlying) into the borrowed asset (cashAsset).

Let’s break down the code and its implications step by step:

-

Splitting the Cash: The comment